At the beginning of April, Covisum rolled out four new features to the Tax Clarity® software. The new dependent tax credit feature allows advisors to demonstrate the impact of the revised dependent tax credit, including for dependents over the age of 16

The Tax Cuts and Jobs Act of 2017 included significant revisions to how dependents are calculated. In the past, a client would claim a personal exemption for each dependent on their tax return. The Tax Cuts and Jobs Act eliminated personal exemptions and instead created a tax credit for both child dependents and non-child dependents.

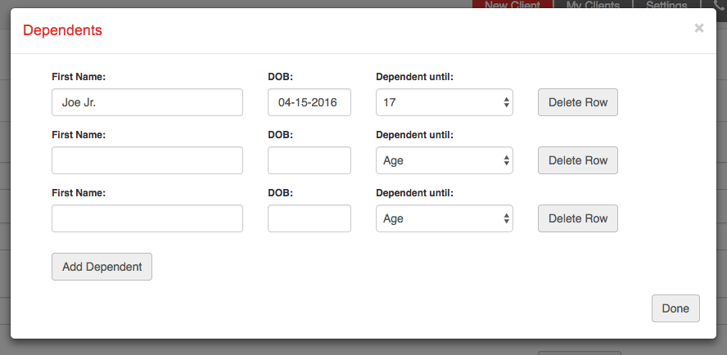

When you select the dependents button in Tax Clarity, a row with text boxes for the dependent’s name, date of birth, and length of time as a dependent will appear (you can add rows by selecting the add dependent button below the text boxes). You also have the ability to classify an adult child as a dependent. You can view future years of tax maps for tax-efficient planning purposes.

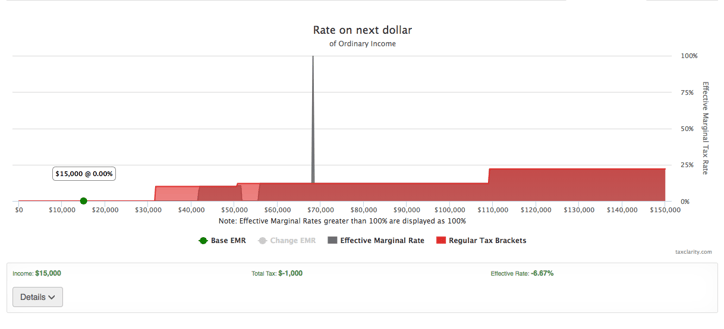

You can see on the Tax Map the area that represents a 0% rate in this range, and that’s the dependent tax credit. This space is where you can take withdrawals without paying any federal income tax. It has a similar impact to what you would have seen with a personal exemption, but it’s treated as a credit in the calculation. You’ll notice it’s refundable up to $1,000. You’ll also see those numbers listed under calculated fields. So, at $15,000 of ordinary income, you won’t be paying any federal income tax, however, you will be able to get a $1,000 tax refund based on the dependent tax credit.

The dependent tax credit is one of many updates to the Tax Clarity software for tax efficient planning. You can get more information about the new features on our blog.