Long-term capital gains can become taxable in certain situations.

A capital gain is the difference between a capital asset's basis and sales price. Capital gains are classified as either short-term or long-term based on the time the capital asset was held. Generally, the gain is considered long-term if you hold an asset for more than one year.

On a standalone basis, the first $96,701 (2025) of long-term capital gains for a married couple filing jointly (MFJ) is not taxable, provided the couple does not have other income. That is rarely the case, and it is, therefore, essential to keep in mind that the taxation of capital gains is determined by taxable income and not simply capital gains.

For a married couple filing jointly (MFJ) in 2025, the thresholds for capital gains taxation are as follows:

|

Taxable Income |

Capital Gains |

|

$0 |

0% |

|

$96,701 |

15% |

|

$600,051 |

20% |

Are these brackets displayed within Tax Clarity?

You can find the table listed above in Tax Clarity by clicking "Brackets & Thresholds" in the "Settings" section of the "Input Data" tab. In addition, you can see the bracket and threshold differences between ordinary income and capital gains, along with tables for exemptions and the possible Medicare impact.

NOTE: When you click on brackets and thresholds, the application will display the thresholds in a separate browser tab.

How can I determine the taxable income used to fill the capital gains tax brackets?

To determine the taxable income within Tax Clarity, subtract deductions and exemptions from the client's Adjusted Gross Income (AGI). If this value exceeds the capital gains threshold, your capital gains will be taxed at the 15% rate.

NOTE: You can find taxable income on Line 15 of the client's 1040. You'll find the values in the details section below the Tax Map.

Example

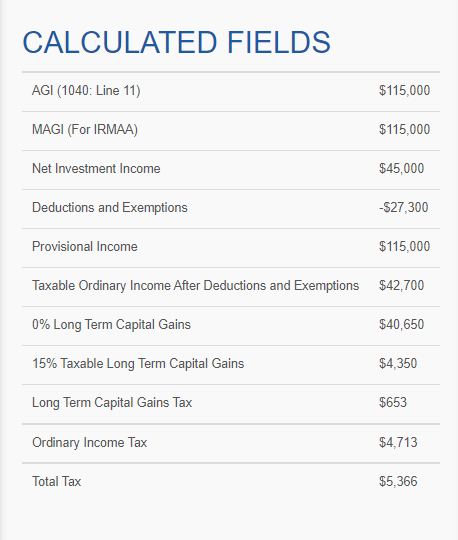

Below you will see an example of using capital gains and ordinary income to determine taxable capital gains. First, determine the taxable income by subtracting deductions and exemptions from the AGI. These values are listed in the details section for each Tax Clarity scenario.

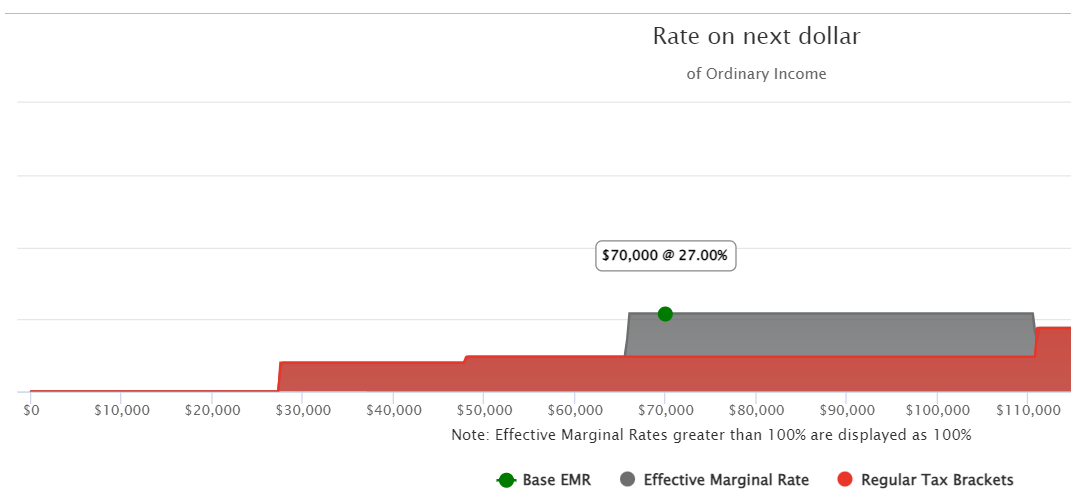

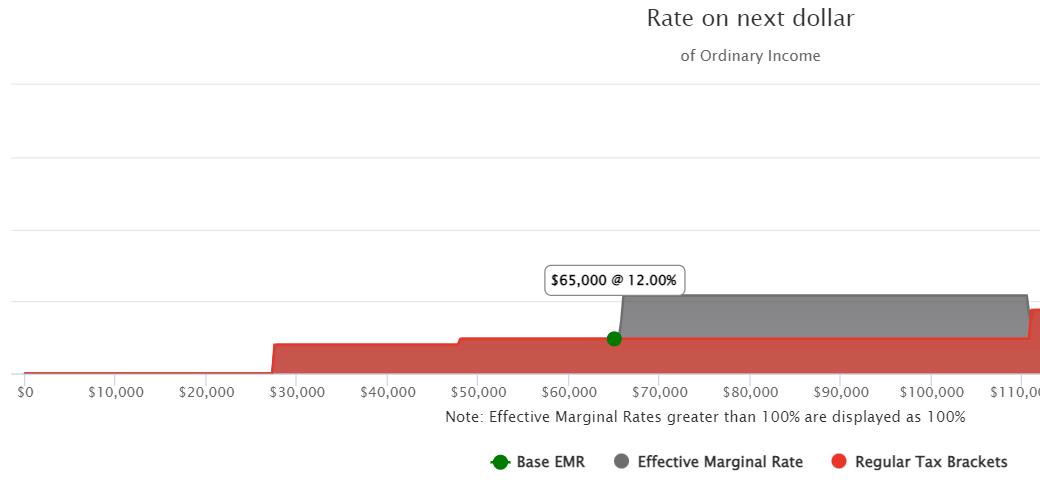

In scenario one, the taxable income is less than the 15% bracket threshold (2021); thus, none of the capital gains income is taxable. While in scenario two, the taxable income is greater than the 15% threshold (2021), so a portion of the capital gains will be taxable. See the Tax Maps below for a visual representation.

Scenario 1

Adjusted Gross Income $110,000

Deductions and Exemptions $27,300

Taxable Income $82,700

Scenario 2

Adjusted Gross Income $115,000

Deductions and Exemptions $27,300

Taxable Income $87,700