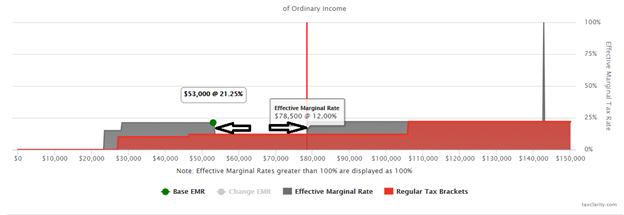

The software shows you where the next dollar harvested from ordinary income would have a minimal effective marginal rate.

As with any financial decision, there are a number of things to consider prior to deciding on making a Roth conversion, and a "best time" to do so is difficult to determine. That said, from a Tax Clarity standpoint, a Roth conversion made when the Effective Marginal Rate is minimal would be best.

Recall that a Roth conversion provides the ability to move money out of a traditional IRA and pay taxes on that distribution at the existing federal and state rates at the time of the conversion. Once made, the funds will appreciate tax-free, and distributions are not ultimately taxed. It is notable that Roth conversions are subject to a five-year "participation" period for the ultimate Roth distributions (above 59 1/2) to be tax-free.

Graphically, as outlined below, the range between $53,000 and $78,500 indicates the next dollar harvested from ordinary income would have an effective marginal rate of just 12%, thus an efficient opportunity for a Roth conversion exists. One should be reminded to use after-tax/non-qualified accounts for conversion tax payments.