If you have both Income InSight and Tax Clarity, you can export the harvesting pattern for a given year and then customize the conversion.

Customizing a Roth conversion with Income InSight and Tax Clarity

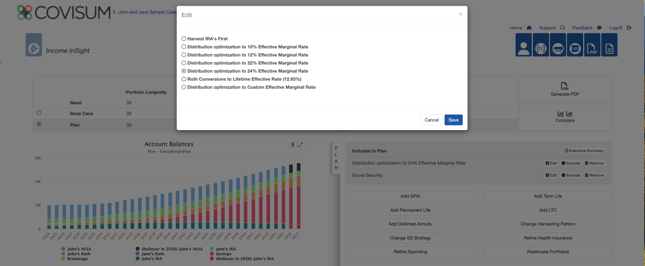

In Income InSight, click the "Plan Tab" on the right side of the results screen, select 'Change Harvesting Pattern' and choose a Distribution Optimization scenario.

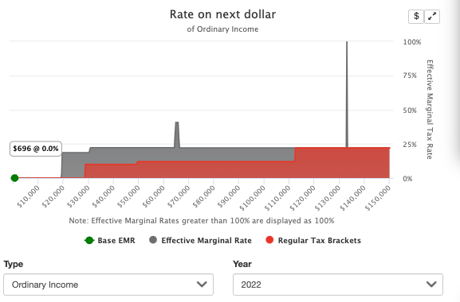

Let's say in this particular year, you'd like to take the conversion to the 24%. When you also subscribe to Tax Clarity, you can view the tax detail, including the conversion amount by click on the dollar sign icon in the top right corner of the Tax Map.

↓

Add the Tax Map to Tax Clarity by clicking the red button in the bottom right corner of the details page.

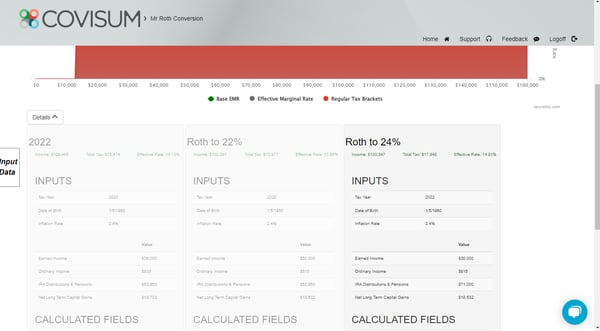

To change the conversion amount, clone your map and increase the IRA distribution amount. Then, you can view a side-by-side comparison of the different strategies.

Note: When you illustrate a customized Roth Conversion in Tax Clarity it will not impact the overall Income InSight results. Typically advisors export Income InSight data into Tax Clarity during annual reviews to finalize actual distributions such as Roth Conversions.

Watch this Demo