Income Insight uses asset classes to determine the expected returns for your clients’ accounts.

Each holding used in a portfolio is assigned a simple cluster such as US Large Cap or Emerging Market Bonds. The simple clusters are assigned to a default asset class which determines the holdings projected returns in Income InSight. Each simple cluster can be customized and changed from Covisums’ defaults settings. View asset classes by clicking "Asset Classes" under the "Portfolio Assumptions" tab on the left side of the homepage.

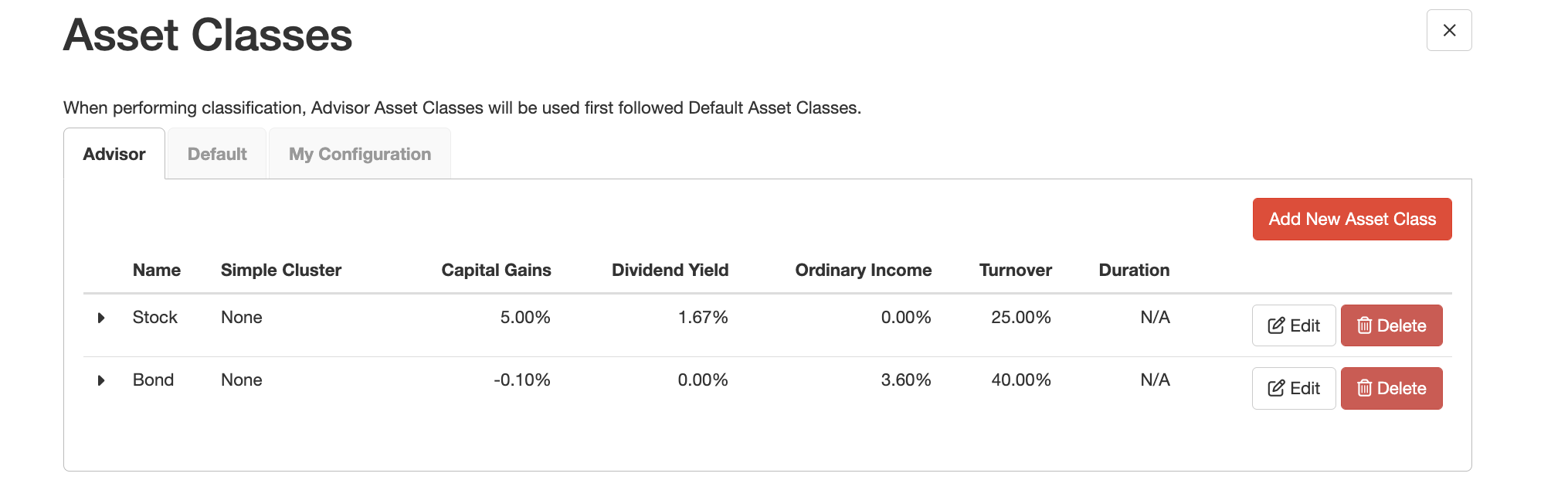

When performing classifications, Covisum will use advisor asset classes first followed by default asset classes. Normal market forecast data is based on the moderate forecase provided by The Index Standard. Down market returns are based on Covisum's SmartRisk model. For additional information regarding asset class returns and usage in Covisum software, please contact assetclasses@covisum.com.

NOTE: The default asset classes are updated quarterly.

To create an alternate asset class:

- Select the advisor tab to create an asset class for each simple cluster that projects different normal, down market, and recovery returns for a specified cluster. (You can also create a fixed return by not selecting a simple cluster at all.)

- Click on "Add New Asset Class" to create your custom class.

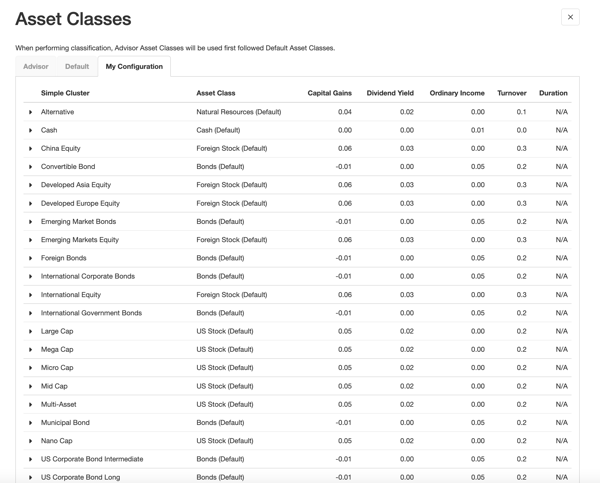

- If you click on "My Configuration", you can see whether we are using the default or advisor asset class for each simple cluster.

Note: If you don’t add advisor asset classes, Income InSight will use the Covisum defaults when projecting returns.