How do I create a custom plan in Income InSight?

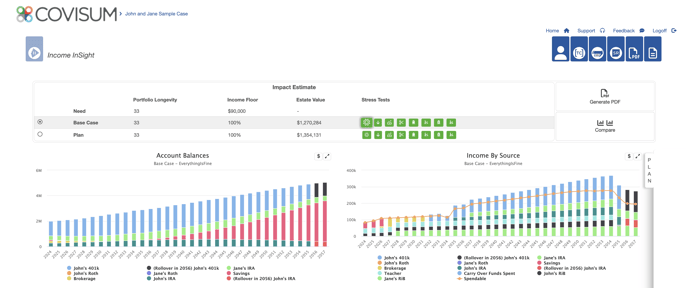

Once a "Base Case" has been entered with all appropriate information and the results are generated, changes can be made to various assumptions based on the success or failure of key plan metrics (Portfolio Longevity, Income Floor and the Estate Value) or the Stress Tests applied to the "Base" Case scenario.

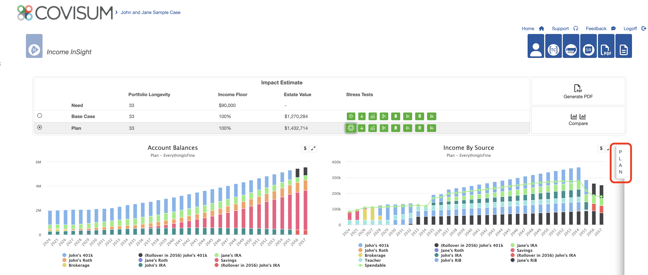

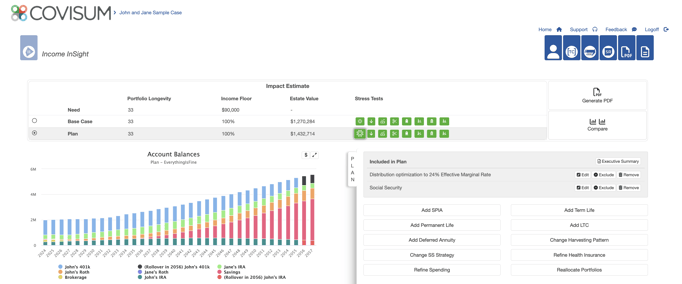

In order to modify a plan, click on the "Plan" tab located on the right side of the results screen, as outlined in red below.

Thanks for joining me. Today, we're diving into how to utilize the compare functionality and gain insights into income strategies with our innovative platform. Let's get started.

First up, we need to add a plan. I’ve selected a strategy that includes a Distribution Optimization to the 24% Effective Marginal Rate coupled with delaying the clients Social Security election.

Income InSight calculates essential metrics, such as the longevity of funds, the percentage of income needs met throughout the client's lifetime, and the net value after taxes left for the people or causes dear to our client.

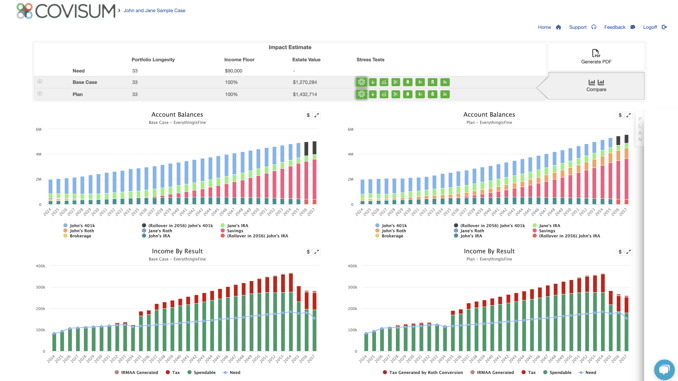

Now, let's explore the heart of our platform—the compare functionality. By clicking 'compare,' we get a visual, side-by-side comparison of the base case versus our newly added plan.

Notice the difference: our base case lacks a Roth IRA, but in our plan, early conversions grow over a lifetime.

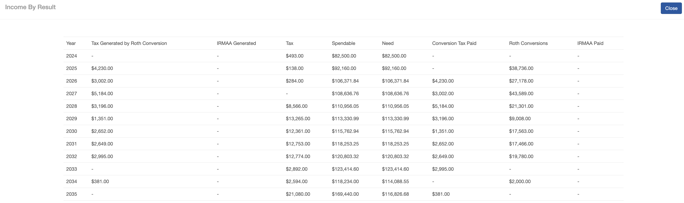

These conversions create a substantial asset, usually for loved ones, thanks to the strategic use of a Roth conversion. The updated charts for each case clearly show the base case against the Roth to Lifetime Effective Rate.

Curious about the conversion amounts? A simple click reveals an annual conversion of roughly $180,000 over ten years, peaking nearly at $44,000 in the sixth year, all while strategically delaying Social Security benefits."

Curious about the conversion amounts? A simple click reveals an annual conversions of roughly of $2000 to $44,000 over nine years, all while strategically delaying Social Security benefits."

The compare tool doesn't just align our cases side-by-side; it also integrates stress tests, allowing us to demonstrate the resilience of our plan against market volatility. Whether facing a down market or planning for future conversions based on account balances, this tool guides our decision-making process.

In total, there are ten different options to choose when creating your alternate plan:

- Refine Spending: Allows for adjustments to spending patterns created in the Base Case.

- Change SS Strategy: Used to illustrate the benefits and trade-offs on earning Delayed Retirement Credits (DRCs) within Social Security.

- Change Harvesting Patterns: Shows the impact of taking qualified assets first or considering Roth conversions. Roth conversions are determined based on the client's Effective Marginal Rate (EMR) or the average EMR.

- Add Deferred Annuity: A fixed or indexed deferred annuity can provide protection in a down market and lifetime income. Qualified Longevity Annuity Contracts (QLACs) may also be considered.

- Add Permanent Life: Permanent life insurance has many advantages for a retirement income plan including, but not limited to, a tax-free death benefit, tax-free income (when structured properly) and accelerated death benefit riders for chronic illness and long term care needs.

- Add Term Life: Affordable coverage for a defined number of years.

- Add Single Premium Immediate Annuities (SPIA): Income annuities can provide lifetime income and are often combined with other guaranteed income sources, such as Social Security or pensions to cover basic needs.

- Refine Health Insurance: Change or add health insurance.

- Reallocate Portfolio: This planning option allows for the reallocation of the portfolio to a pre-defined level (conservative, moderate or aggressive) or a custom model portfolio. Reallocation can be used to examine overall risk/reward dynamics, and the changes will impact the down-market stress test results.