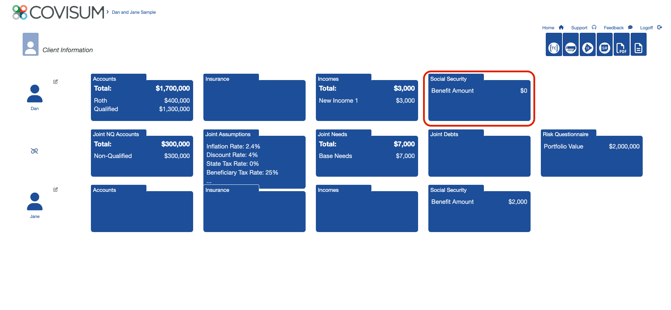

From the client information screen, click on the client's Social Security folder enter their statement information.

Welcome to our step-by-step guide on entering Social Security benefits into Income Insight. Let's dive in.

First, navigate to the Social Security folder within the Income Insight system. This is where you'll begin the process.

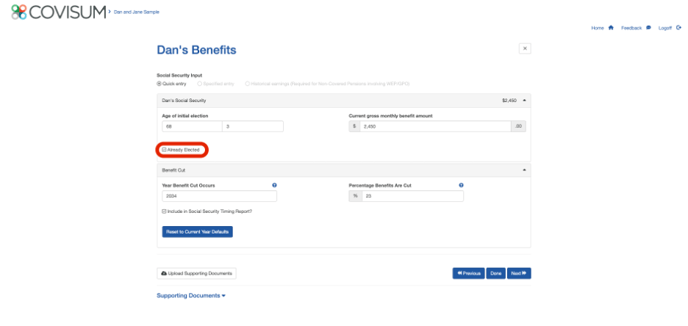

Most users will find the Quick Entry feature most convenient. Here, you'll enter the statement date and the full retirement age benefit of the client. If the client is older than full retirement age as of the statement date, you'll be prompted to enter the earliest time that is quoted on the statement.

For clients who have already elected their benefits, simply check the 'Already Elected' box. Let's say Dan has elected at age 63 and 8 month and is receiving $2450 today. When entering her information, make sure to provide the current gross monthly benefit amount, which is the amount before any deductions, like Medicare premiums or taxes. This information is crucial for accurately calculating the primary insurance amount, important for survivor calculations.

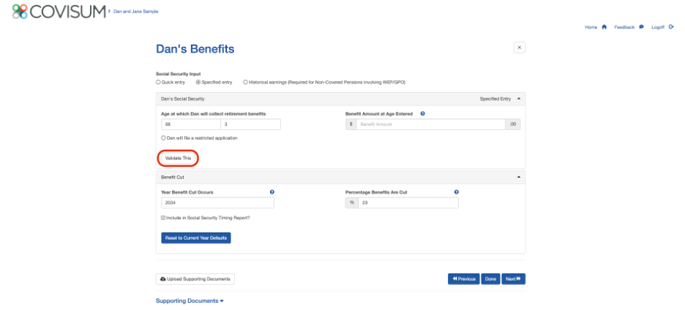

For more complex situations, such as when a client has a specific Social Security strategy, use Specified Entry. For example, if Joe decided to collect benefits at 68 and three months, input the benefit amount he would receive at that age from the Social Security Statement

Now select "Validate This" to make sure that the strategy is valid. If Dan is entered as collecting benefits at 62 and 0 months, the system will flag this as invalid, since his minimum age to collect is 62 and one month, due to a specific Social Security rule.

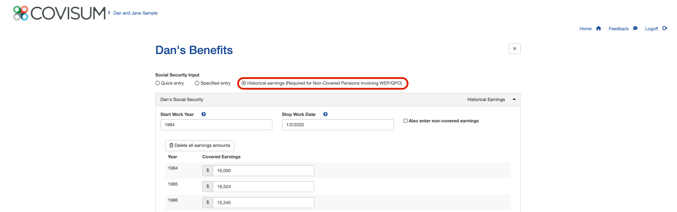

The Enter Earnings method stands out for its precision and flexibility. It's designed for those who seek a detailed and personalized estimate of their Social Security benefits. This method allows users to input their specific earnings data. By doing so, it creates a benefit estimate that mirrors your actual earnings history, ensuring the highest degree of accuracy. It's particularly useful for stripping out the embedded assumptions found in standard Social Security benefit calculations. Moreover, the Enter Earnings method is essential for individuals impacted by the Government Pension Offset or Windfall Elimination Provision. These provisions can significantly alter your benefit amounts. For those affected, a customized calculation becomes crucial for accurate planning. Once we are done entering in the clients benefit information simply click done.

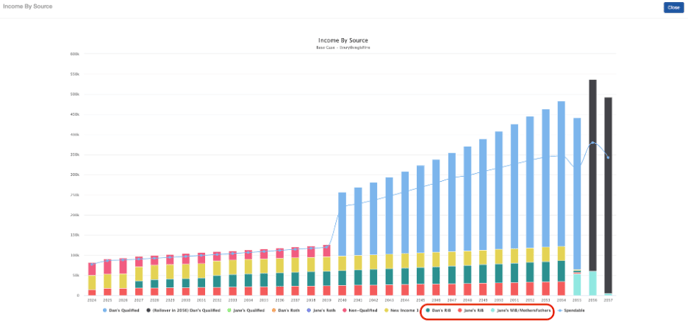

After clicking 'Done', to see the results, switch to the Income Insight tab and go to 'Income by Source'. Here, you can expand the section to see the benefits, like Joe's retirement insurance benefit, and observe how it increases over time for inflation.

You'll see how each benefit is scheduled to start and increase over time, providing a comprehensive view of the client's future income.

And that concludes our guide on entering Social Security benefits into Income Insight. Thank you for following along. With these steps, you can efficiently manage and plan your clients' Social Security benefits.