How do I enter my client's income into Income InSight?

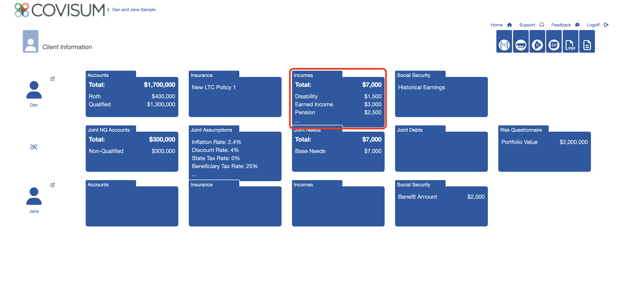

From the client information screen, click on their incomes folder, then click add income.

Welcome to our step by step guide adding income in Income Insight! So, let's get started!

First off, we're heading to the incomes folder.

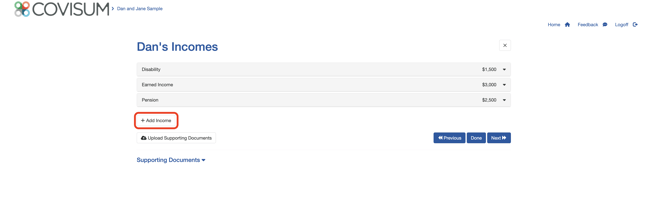

Here, you'll find the 'Add Income' button.

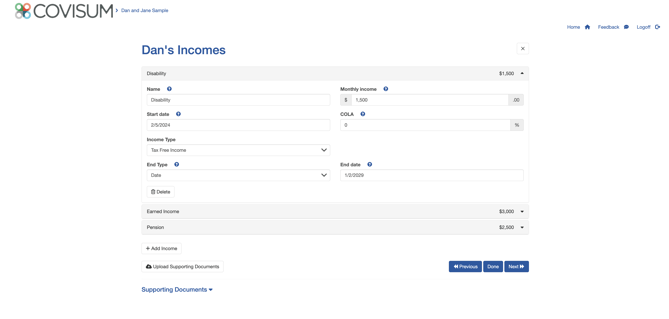

When selected will allow you to enter different income types. Income Insight primarily deals with four types of income: Earned Income, Pension Income, Non-Covered Pension Income, and Tax-Income. Non-Covered pensions trigger the Social Security Windfall Elimination and Government Pensions Offset provisions for Social Security because the worker did not pay Social Security taxes while contributing to the pension. And tax free income include things like disability payments.

I've already set up three different payment types.

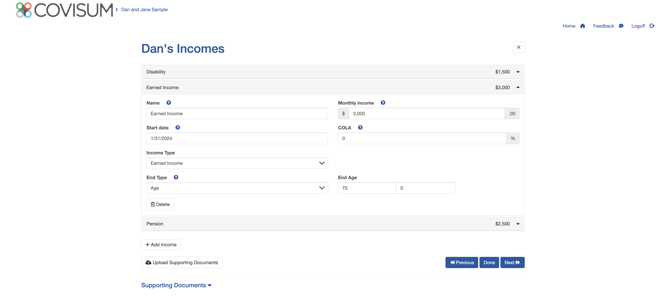

Let's kick things off with Earned Income. Imagine you're entering a monthly figure—say, $3,000. And here's a pro tip: You don't need to backtrack. Starting at the beginning of the year works just fine.

Dan's expecting a 3% raise on average and Dan plans to work until age 70.. Earned Income is crucial in order to determine any reductions to Social Security due to the earnings test.

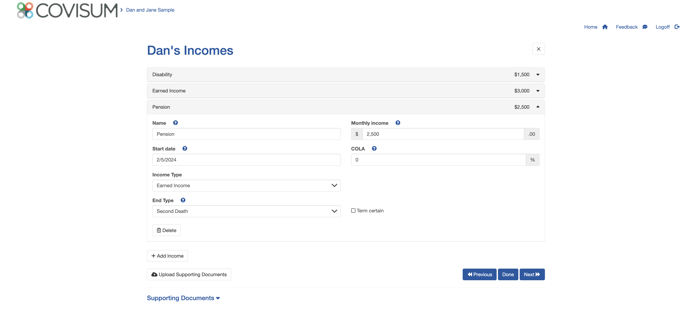

Now, let's switch gears to Pension Income. We added a monthly pension of $2,500, again there's no need to go back in time so the start date can be January of 2024, but you have the option to start in the future if necessary. If the pension will begin in March of 2027 we can choose that date.

Unlike many pensions, Dan's doesn't have a COLA. In this case we will choose pension instead of a non-covered pension. For the end type? We're choosing "Second Death" for a joint and survivor pension, steering clear of term certain options.

Finally, we can enter in a Tax Free Income source such as a disability payment. Let's assume our client became disabled in February 2024 and disability payments are expected to last 5 years. These payments will be classified as tax free income.

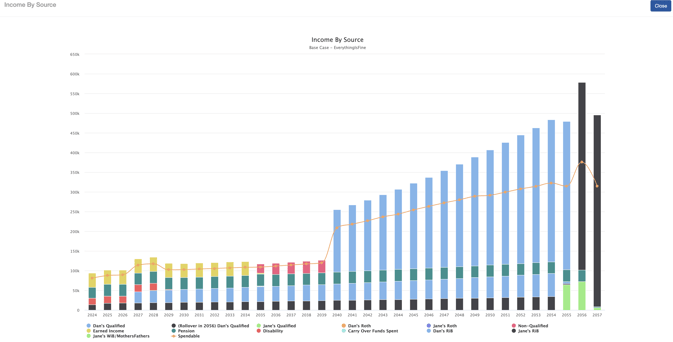

Wondering about the impact? Simply head back to the income insight results screen to see Dan's work income beautifully laid out. A closer look reveals $2,000 monthly, amounting to $24,000 yearly, lasting as long as either is alive. And in a twist, when the second death occurs in 2052, only $8,000 is collected that year. Earned Income payments that stop at the clients age 70 and a disability payment.

And there you have it! Whether it's navigating through earned income or deciphering pension intricacies, you're all set to make informed decisions.