The software will default to standard if there are no inputs under Schedule A or if the total of the inputs entered is less than the standard deduction for the chosen filing status.

Standard Deduction for 2025

- The standard deduction for married couples filing jointly is $30,000.

- The standard deduction for single taxpayers and married individuals filing separately is $15,000.

- The standard deduction for heads of households is $22,500.

The deduction amount typically increases every year. The items that are exempt from taxation and the rules for calculating the totals can be found here. Keep in mind– taking the larger of either the standard deduction or itemized deductions will result in fewer federal taxes.

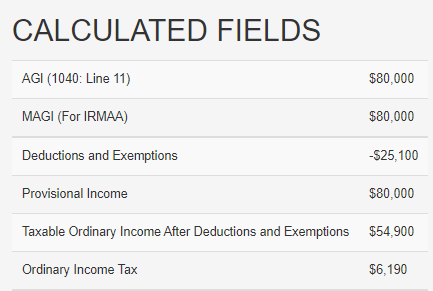

To Verify the Deductions and Exemptions

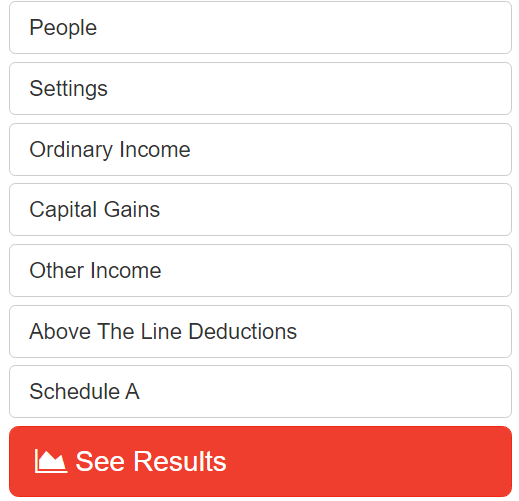

- Click the "Input Data" on the left side of the screen.

- Select "See Results."

3. Scroll to the bottom of the page, below the Tax Map, to the "Details" section.

4. Review the deductions and exemptions under "Details."