There are two way to enter earnings and hypothetical future earnings for Social Security to trigger the earnings test in Social Security Timing and Income InSight.

1. Quick Entry OR Specified Entry

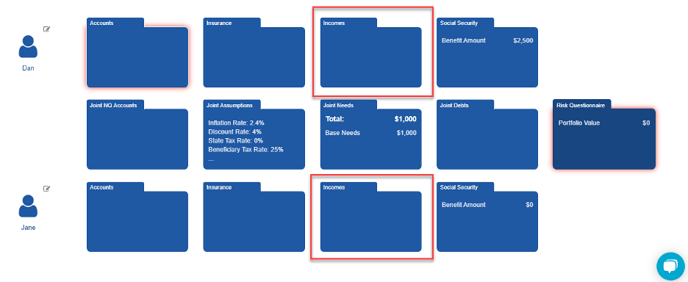

Step 1: Enter income by selecting the “income" folder.

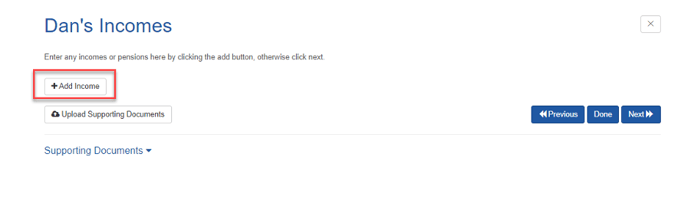

Step 2: Click "Add Income."

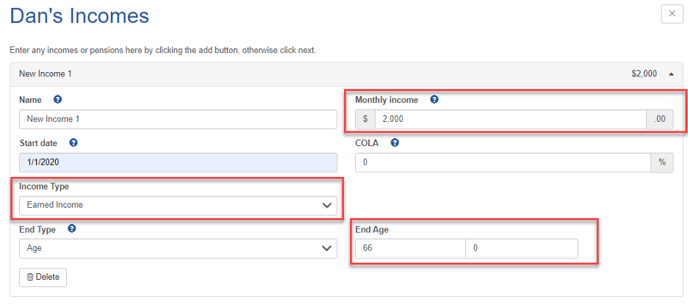

Step 3: Enter the monthly earnings for your client. Choose "Earned Income" for the income type to ensure that the earnings will be counted towards the earnings test. Select either specified date, age, or death as an end date for the income. It is important to note that incomes entered here will not impact the Social Security benefit estimate just the earnings test.

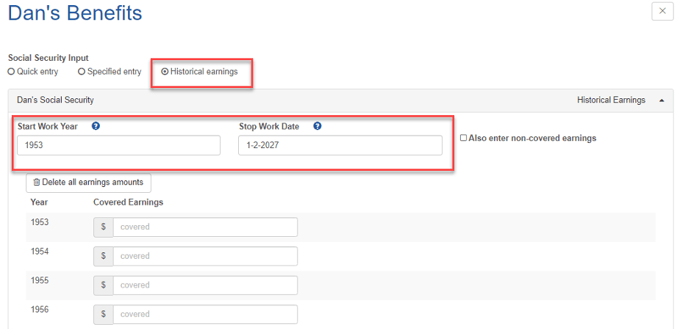

Historical Earnings

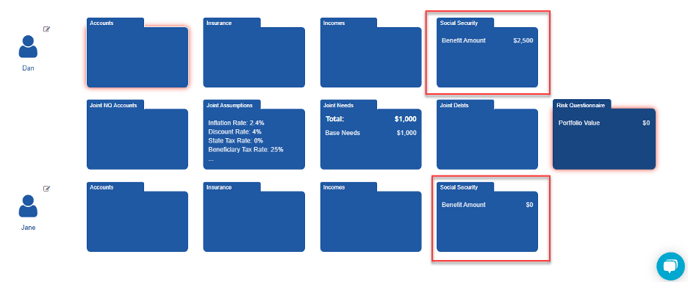

Step 1: Past and future earnings are entered under historical earnings entered under the Social Security Folder. Select Social Security folder for either the client or spouse.

Step 2: Select historical earnings and enter the starting year from the client's Social Security statement. The stop work date should be the date in which the client plans to stop working.

The earnings test will be calculated once you enter historical earnings past the client’s eligibility age (62 for retirement benefits, 60 for widow(er)s benefits) through the year the client reaches full retirement age. Any reductions will be outlined in the strategy instructions. This calculation is applicable to both Social Security Timing and Income InSight.