Military retirement benefits are included in the earnings used to calculate Social Security benefits. They aren’t treated as separate income.

When adding income into Social Security Timing, military benefits do not need to be added separately. Military earnings are already included in the income used to calculate a Social Security benefit. Military earnings are credited in the same manner as a civilian worker. You must earn 40 credits or 10 years of work to be considered fully insured in order to qualify for a Retirement Insurance Benefit. If your service was earned after 1957 it is considered a covered service. You are entitled to both military retirement benefits and Social Security benefits.

A few important reminders about military benefits.

- Generally, the benefit is not subject to reductions like the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO).

- Your Social Security benefit amount is based on all your earnings (including military benefits).

- You pay Social Security tax on your military earnings the same as a civilian.

- Survivor benefits are paid.

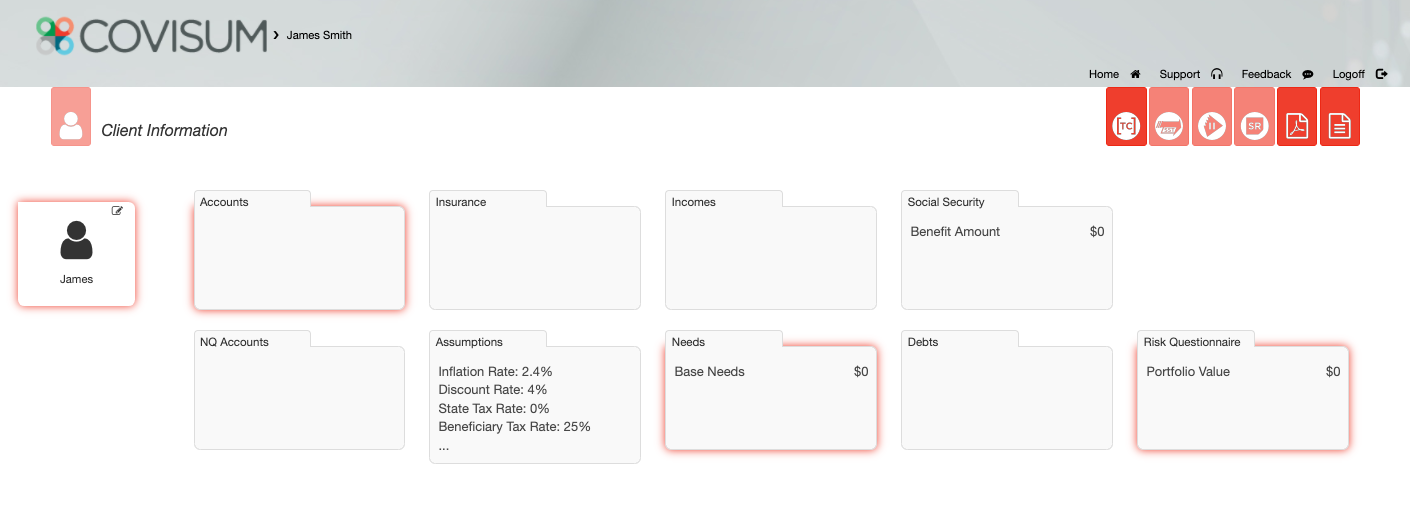

Note: Military benefits do not need to be entered separately into Social Security Timing. They are already included in the Social Security benefit amount.