When a client logs into their My Social Security account, they should click on ‘Review Your Full Earnings Record Now’.

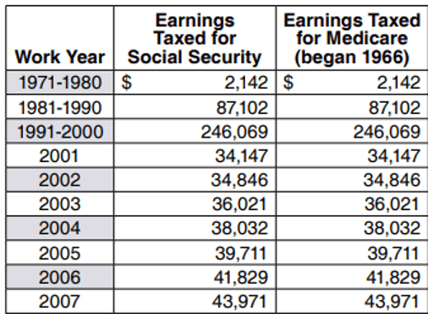

Historically your client would only need a copy of their own Social Security statement to access their taxable Social Security earnings history. However, the Social Security Administration updated the Social Security statement, and the new statement groups together earlier years of earnings, typically in 10-year blocks. See a sample of the new earnings history below.

It’s important to know that you should not average the amount of the earnings in the grouped period as the benefit formula calculation includes average wage indexing. Average wage indexing brings forward past earnings to account for a general rise in the workers standard of living. Since each year is independently indexed to age 60, you can significantly change the benefit estimate by averaging the earnings. We suggest having the client login to their My Social Security account and obtain a copy of the ungrouped work history.

Note: The Social Security Administration no longer automatically mails statements. Therefore, your client will have accessed their My Social Security account to provide you with their Social Security statement.

When a client logs into their My Social Security account, they should click on ‘Review Your Full Earnings Record Now’. This is located under the eligibility and earnings section of the home page. The client will then need to copy and paste the earnings into an excel document or take screenshots of the earnings history.