Saver's Credit in Tax Clarity

The saver’s credit is a tax break to low-and moderate-income taxpayers saving for retirement. If someone meets the following criteria, they are eligible to receive up to 50% of their contribution up to $2,000 per taxpayer:

- Age 18 or older

- Not claimed as a dependent on another person’s return, and

- Not a student

The percentage of the saver’s credit the taxpayer is eligible diminishes as their Adjusted Gross Income (AGI) increases. The chart below illustrates the credit rate the taxpayer is eligible for regarding the AGI on the tax form 1040.

|

Credit Rate |

Married Filing Jointly |

Head of Household |

All Other Filers* |

|

50% of your contribution |

AGI not more than $43,500 |

AGI not more than $32,625 |

AGI not more than $21,750 |

|

20% of your contribution |

$43,501- $47,500 |

$32,626 - $35,625 |

$21,751 - $23,750 |

|

10% of your contribution |

$47,501 - $73,000 |

$35,626 - $54,750 |

$23,751 - $36,500 |

|

0% of your contribution |

more than $73,000 |

more than $54,750 |

more than $36,500 |

Qualifying contributions include traditional or Roth Individual Retirement Account (IRA), elective salary deferral contributions to a qualifying plan, voluntary after-tax employee contributions made to a quailed retirement plan, 403b, 501(c)(18)(D), or Achieving a Better Life Experience (ABLE) Account. It is important to note that rollover contributions do not qualify for this credit.

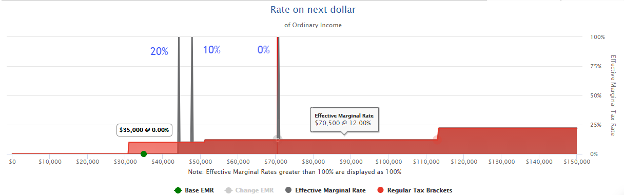

Tax Clarity visually illustrates when a client’s saver’s credits will decrease based on their calculated AGI by adding an IRA plan contribution under the “above the line deductions.” For example, Tax Clarity will generate the following Tax Map (2021) for a married couple under the age of 65 with $43,000 of earned income and $4,000 of plan contributions:

Notice that the credit is reduced after reaching each spike on the Tax Map. These spikes coincide with the AGI illustrated in the chart above.

Additionally, the effective marginal rate does not start until the first spike begins, illustrating no tax even after the 10% bracket begins. A tax credit is a one-to-one deduction of tax dollars, and the calculated tax is less than the credit in this case.