View the "Asset Classes" tab under the "Portfolio Assumptions" section on the Income InSight homepage.

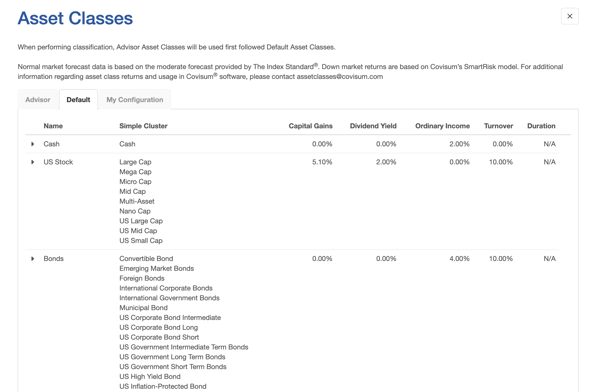

The down market stress test is modeled on the assumptions made within the "Asset Classes" tab, under the "Portfolio Assumptions" section, on the Income InSight homepage. Covisum sets defaults classes that may be over written by the advisor.

Asset Classes:

Holdings within a given portfolio are assigned a simple cluster that is attached to an asset class. The asset class determines the normal, down market, and recovery returns for the holdings.

What if I use SmartRisk?

The down market will be based on "heavy tailed" methodology used in SmartRisk and analysis of the actual portfolios entered for the client. Ultimately, the value added by adding client specific investment and portfolio data is worth the effort to obtain it. There are several methods you can use to add a clients portfolio into Income InSight (ByAllAccounts import, Redtail Import, CSV Import, and Manual data entry)