Medicare Surtax

Tax Clarity takes into consideration the additional 0.9% Medicare tax that applies to wages, self-employment income and railroad retirement (RRTA) compensation that exceed certain thresholds based on the taxpayer’s filing status. Please note that the 0.9% Medicare surtax is not an increase in Medicare premiums per se, it is a tax on income based on the following thresholds:

- $250,000 for married filing jointly

- $125,000 for married filing separately

- $200,000 for all other taxpayers.

For example, couples who are married and filing their tax return jointly must combine their wages, compensation and self-employment income with spousal income. If their income exceeds $250,000, a Medicare surtax will be applied.

Taxpayers who owe the additional Medicare surtax should file IRS Form 8959 with their tax return. Additional taxes withheld by their employer can also be reported on the IRS Form 8859.

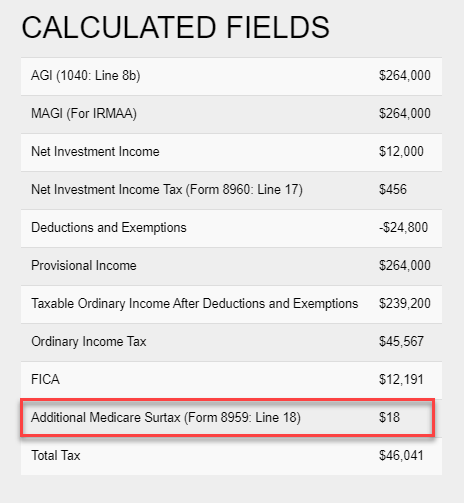

In Tax Clarity, for a married couple filing jointly (MFJ) with earned income of $252,000, the Medicare surtax would be based on the $250,000 threshold. As such, $2,000 multiplied by 0.9% would equate to an $18 surcharge. The Medicare surtax is located towards the bottom of the details in the calculated fields near the total tax figure.