Income InSight applies a flat tax rate to all taxable income. Tax Clarity can apply state taxes as an itemized deduction on Schedule A when total deductions are greater than the standard deduction.

Income InSight

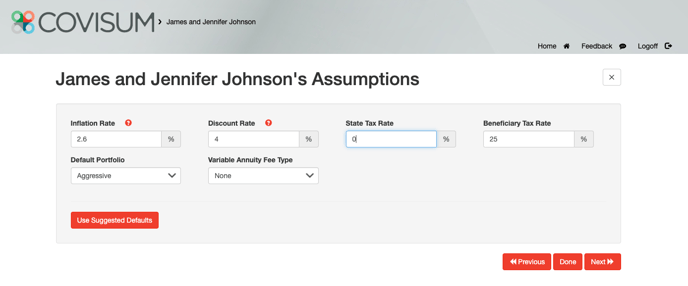

You can add a state tax rate by clicking the "Assumptions" folder on the client information page.

Once you add a state tax rate to the appropriate box, the software will automatically apply the rate listed to all taxable income, including both ordinary income and capital gains. Non-taxable income such as tax-free interest, Roth withdrawals, or basis withdrawals are excluded from the state tax calculation.

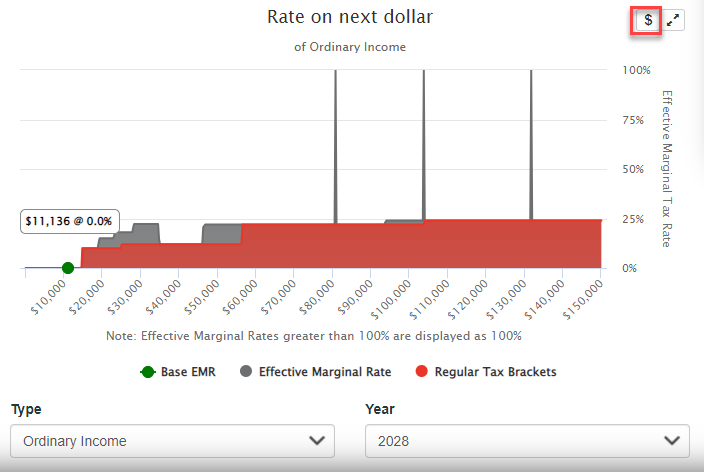

A summary of state taxes will show up on under the details in the ‘Rate on next Dollar’ chart when you have a Tax Clarity subscription. Click on the $ sign to access the tax details.

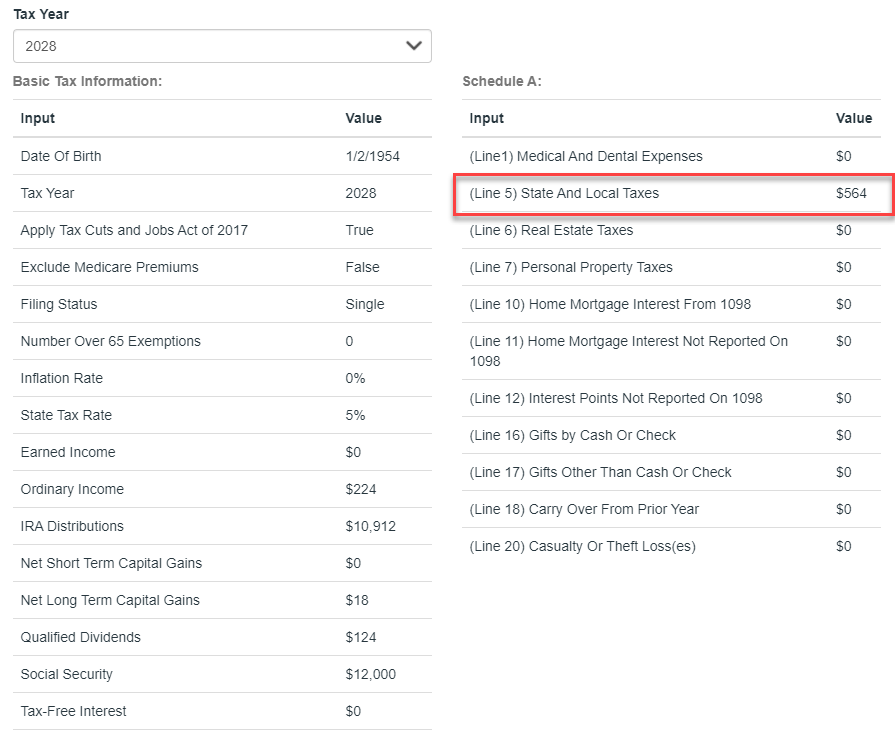

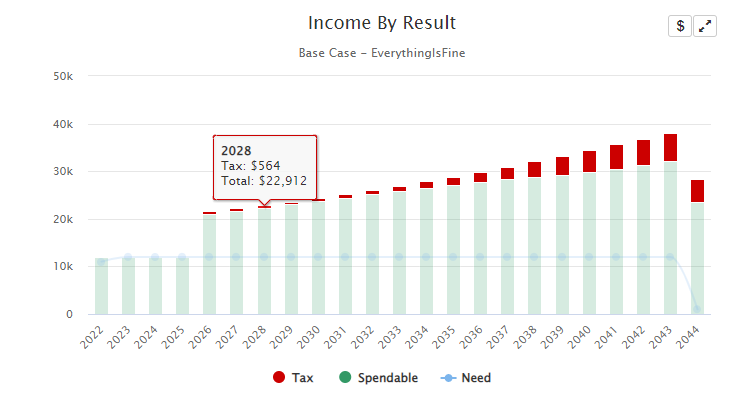

For instance, the client has the following taxable income:

$224 Ordinary Income

$10,912 IRA distributions

$18 Long Term Capital Gains

$124 Qualified Dividends

$11,278 Taxable Income

Note: In this scenario the Social Security benefits are not taxable because the provisional income is less than the $25,000 threshold. State taxes are $564 or 5% of the taxable income.

Regardless of whether you have Tax Clarity or not the state taxes will be included in the overall tax bill illustrated on the ‘Income By Results’ chart. You will notice that the overall tax bill in this case is equal to the state tax. This is because there are no federal taxes in this illustration.

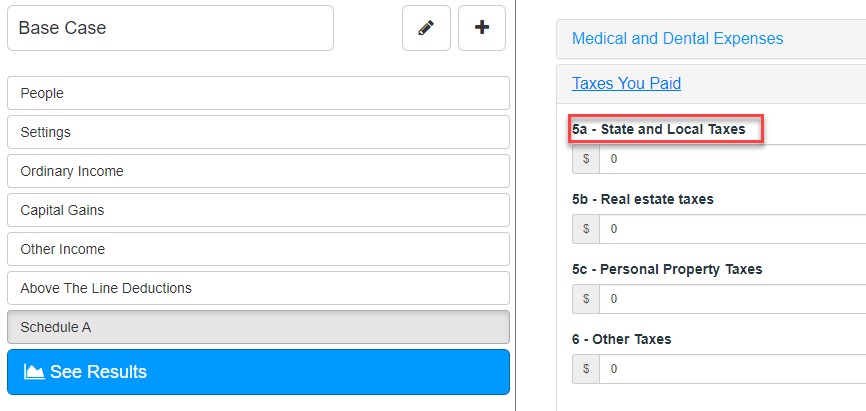

Tax Clarity

Tax Clarity does not calculate state taxes and it will not display state taxes. However, you can include state taxes as an itemized deduction on the client's Schedule A. The federal taxes are adjusted if you get a deduction for any state tax paid and you enter that on the Schedule A.