This type of product is also known as Asset Based LTC

Assuming these policies are not single-premium life insurance policies, and ongoing premiums were being paid, it is common that the future premiums are waived under a "waiver of premium" during the time of the claim. Income InSight, therefore, assumes such a waiver is in place in its calculations. Any elimination periods built in the LTC rider should be considered as premiums will be required until that elimination period is complete, and an input field is available in the long-term care section of the client profile. The effect of these will be accounted for within Income InSight and can be seen within the "Income by Result" analysis.

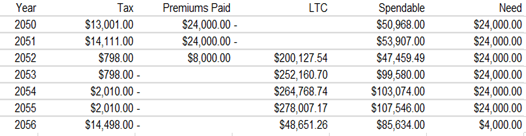

The "$" tab in the upper right corner of the "Income by Result" chart in Income InSight will provide the data in a tabular form, an example of which is below. The second column will indicate the premiums are no longer being paid. To confirm other conditions in the model, check the "Insurance" tab in the client information folder. The Income InSight assumptions for the long-term care stress test are $4,000 per month, inflation adjusted, for the last 48 months of life.