How are required minimum distributions (RMDs) calculated?

Required minimum distributions are automatically calculated in Income InSight when the client reaches age 72.

Required minimum distributions (RMDs) are the minimum amount you must withdraw from your IRA, SEP IRA, SIMPLE IRA, or retirement plan account each year. However, you can withdraw more than the minimum required amount. If an individual reaches age 72 in 2020 or later, they must take their first RMD by April 1 of the year after age 72.

Note: Required Minimum Distributions beginning at 70 1/2 if your date of birth is prior to 7/1/1949, at 72 if your date of birth is between 7/1/1949 and 12/31/1950, 73 if your year of birth is 1951-1959 or 75 if your year of birth is 1960 or later.

Calculating RMDs

Calculate RMDs by dividing the IRA account balance from the previous year by the distribution period factor based on the client's age in the current year. Then, repeat the calculation for all other appropriate and applicable accounts.

How does Tax Clarity display RMDs?

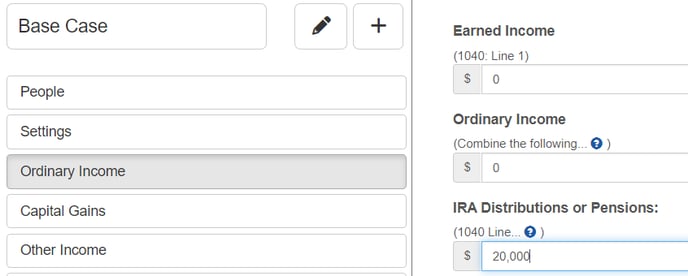

To account for RMDs in Tax Clarity, enter the RMD amount in the "Ira Distribution" field on the data input page. Please note the distribution is considered ordinary income.

How does Income InSight account for RMDs?

Income InSight automatically calculates RMDs when the client reaches age 72. Taxes for the RMDs are taken from the first non-qualified source listed in joint non-qualified accounts. If there isn't a non-qualified source listed, Income InSight will take taxes from the qualified account from which the withdrawal was initially taken.