The Social Security Administration allows certain workers up to six months to file retroactively.

Retroactive Filing

As a general rule, the Social Security administration allows workers who qualify for Social Security Retirement Insurance Benefits (RIB), Widow(er)’s Insurance Benefits (WIB), and Spousal Benefits (SP) to file up to six months retroactively. A few important things to remember about retroactive benefits:

- Retroactive benefits will be paid back to the month the client reached their full retirement age (FRA).

- The benefit amount will be less than if they would have elected benefits at the time of filing.

- The benefit will be based on when the worker initially decided to elect benefits.

It is also important to note that the past payments are paid as a lump sum when the worker receives their first payment, typically in the month following the actual month of the election.

There are exceptions for WIB, Disability Insurance Benefits (DIB), Hospital Insurance (HI), and Childs Disability Benefits (CDB). A typical exception to this rule is if the worker is in protective filing status. This means if specific criteria are met, then the Social Security Administration establishes a protective filing date, and the worker can file on that date even if it has passed.

Retroactive Filing in Social Security Timing

When determining the suggested strategy, Social Security Timing will automatically consider retroactive filing based on the general rules for a RIB, WIB, or SP benefit. You can illustrate benefits starting at any point in the past with the "create your own strategy" feature.

For clients who have already elected benefits, or in cases where the suggested strategy has deemed the early election acceptable, the strategy claiming instructions may include a benefit election date in the past. Keep in mind that life expectancy can play a role in determining if a client should file for benefits early, especially in cases where the person is single.

Example

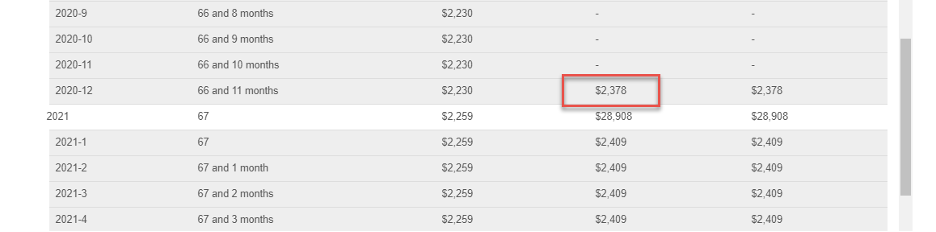

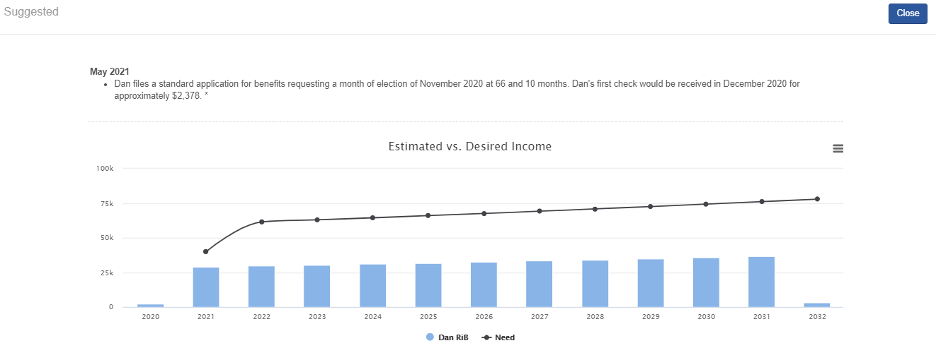

Assume that the current date is 5-6-2021. We generate a report for a single client born on 1-2-1954 with a life expectancy of 78 years. In this case, the suggested strategy represented below has the client filing a standard application for benefits in May 2021 for a month of election in November 2020 at age 66 and 10 months.

Notice that the cash flows show benefits beginning in December of 2020–illustrating the benefits the clients would receive in the past. The client will receive a lump sum payment for all past payments on their first check.