Clone the base case and add additional IRA distributions to show Roth conversions.

Tax Clarity can help you identify how much to convert before you reach the next marginal tax rate.

Case Study

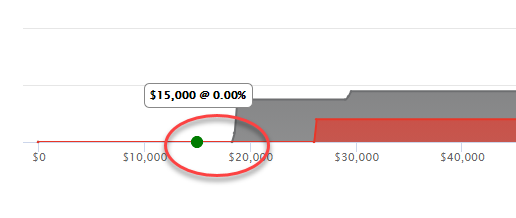

- Ordinary Income: $15,000

- Long Term Capital Gains: $5,000

- Social Security: $45,000

Place your cursor on the map to determine the Roth conversion amount you would like to illustrate.

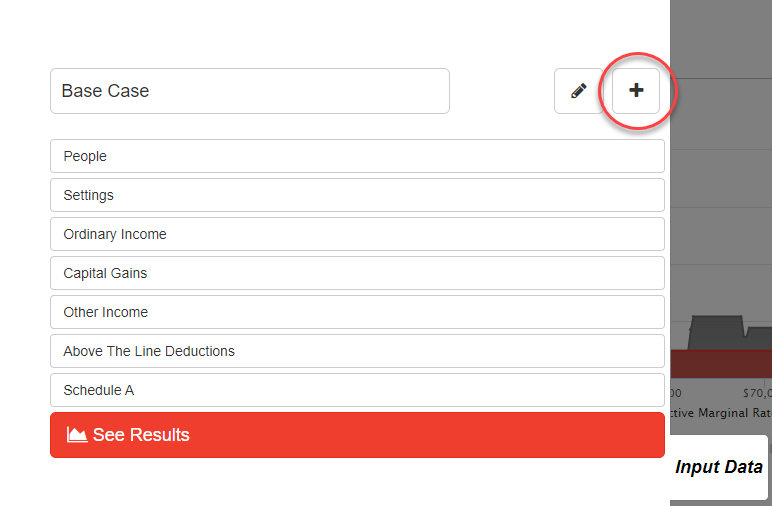

To illustrate a Roth conversion:

1. Select the "+" to create an alternate scenario.

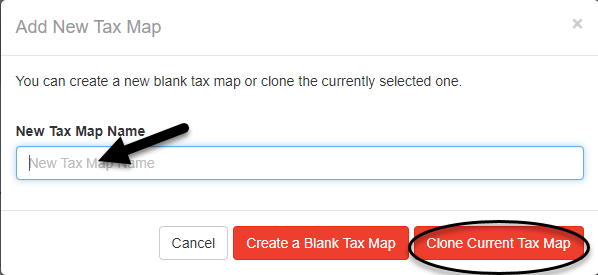

2. Name the new scenario and select "Clone Current Tax Map."

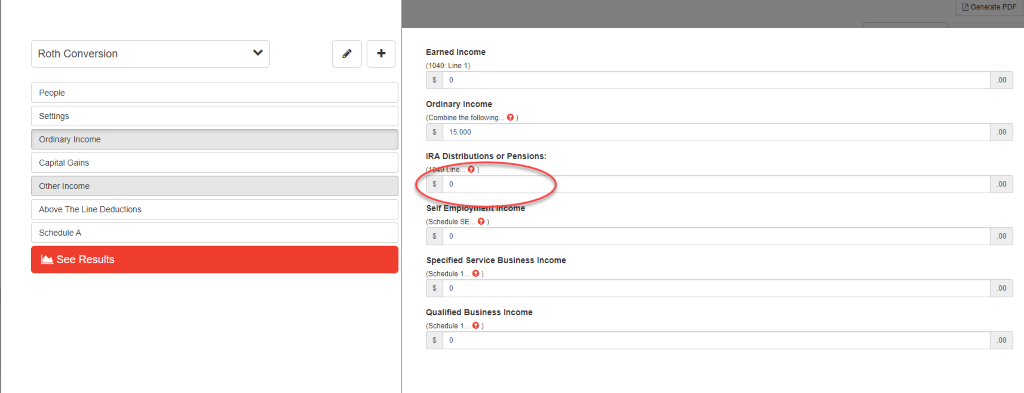

3. Add desired IRA distribution under ordinary income.

4.Review the Tax Map and "Details."