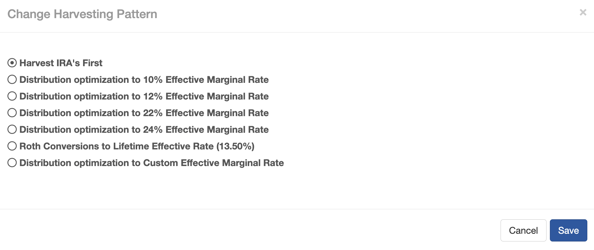

Also considered a "Do No Harm" conversion, the "Roth Conversion to Lifetime Effective Rate" tab will calculate the average tax rate using non-qualified account distributions. It will never convert more to a Roth than the total paid in taxes in the scenario being prepared.

Income InSight will also allow for comparisons based on the Tax Map and the effective marginal rates in the case.

The Lifetime Effective Rate is calculated by dividing Total Tax / Total Cashflows over the course of the client's lifetime. Currently, lifetime tax is displayed in the Income InSight report, in the "Base Case: Income by Source” section.

Example

- Lifetime Tax = $149,240

- Total Cashflows = $1,581,915.06

- Lifetime Effective Rate is: $149,240 / $1,581,915.06 = 9.43%

It's important to note if this option is selected and the Effective Marginal Rate is 12% in particular year, there would be no conversion in that year because the Lifetime Effective Rate is 9.43%, which is less than 12%.