SmartRisk's side-by-side comparison demonstrates your client's base case right next to their reallocated plan case.

Understanding the Portfolio Comparison Feature in SmartRisk

- Log into software and select a client or add a new one.

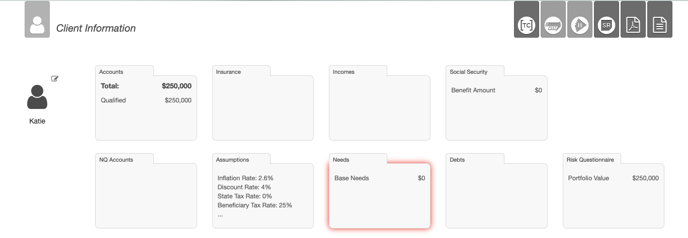

- Enter all client financial information within the folders on the next page. A red halo around a folder represents incomplete information, and you will need to complete it.

- Select the SmartRisk logo in the top right-hand corner.

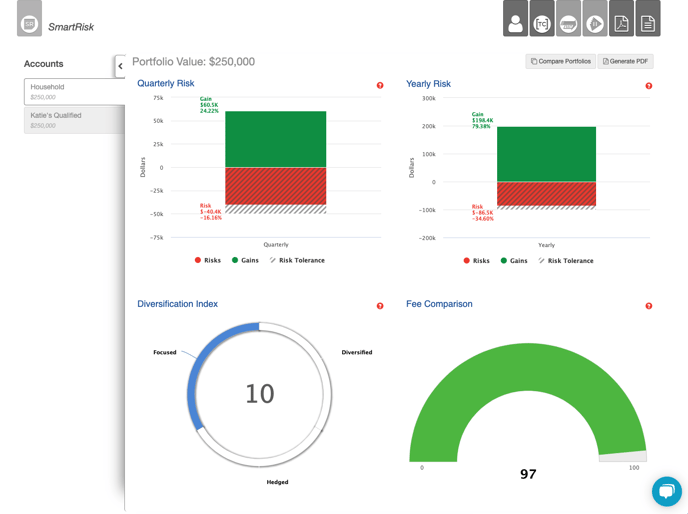

- You will now see a risk analysis of your client’s account. The graphs you will see are quarterly and yearly portfolio risk models, a diversification index, and a fee comparison chart.

- Clicking on Compare Portfolios at the top right will give you the option to reallocate accounts and compare the risks between the two.

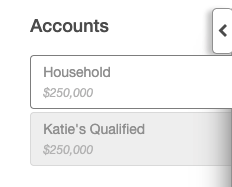

- The Accounts tab on the left-hand side allows you to switch between household and other accounts.

Check Out This Video Demonstration:

Transcription

Let’s talk about how to use SmartRisk in a client meeting. Oftentimes, clients will have multiple accounts. They may have an IRA, Roth or a non-qualified account. You may have a married couple where each person has an IRA or Roth. You might have clients with different goals or spending orders for those accounts. In this case all of the accounts are actually invested in a very similar manner. So, if I click on any one account I’ll see is that the risk properties of any one account are similar of the risk properties of the household.

Let’s say that I wanted to reallocate this client's accounts in order to bring their risk more in line with their tolerance. I would:

- Compare portfolio

- Select start new comparison

- Reallocate to different models

You have the option to reallocate all accounts to one model. Two accounts are IRAs for both Dan and Jane. I may choose to reallocate those accounts to their individual risk tolerance. The next account is a Roth so maybe I'll be more aggressive, because I know the likelihood of the client using those assets in their lifetime is small. The last account is a non-qualified account that I know they are going to use early in retirement, so we will be more conservative.

Now let's compare. The first thing you’ll notice is that both portfolios are compared side by side. You’ll also notice that the clients' risk is more inline with the clients' risk tolerance. You know that because the grey bars extend beyond the portfolios range of risk. The other thing you’ll notice is that the risk reward range is much tighter. The diversification index also went up, so in times of stress this portfolio is more likely to offset some of the holdings with the movement of other holdings. Finally, I have a portfolio with a slightly higher internal fee comparison number which means that the internal fees are less.

I was able to have a conversation with the client that prepared them for their downside risk exposure regardless if any changes where made.