IRMAA is a surcharge added to Medicare Part B & D premiums based on your clients modified adjusted gross income from two years ago.

Medicare Premiums are increased based on your client's Modified Adjusted Gross Income (MAGI) two years before the current year. These premium increases are illustrated as a 100% effective marginal rate spike on the Tax Clarity tax map for clients aged 63 and older.

For instance, if your client's MAGI in 2022 was greater than $103,000 for a single or $206,000 for a couple married filing jointly, then they will pay a surcharge in addition to their normal premiums.

The client's Modified Adjusted Gross income is your client's AGI plus:

- interest from U.S savings bonds used for higher education,

- earned income for U.S citizens living abroad that was excluded from Gross Income, and

- income from sources for U.S territories not already included in the Adjusted Gross Income.

Note: Tax Clarity does not allow you to enter the additional income listed above.

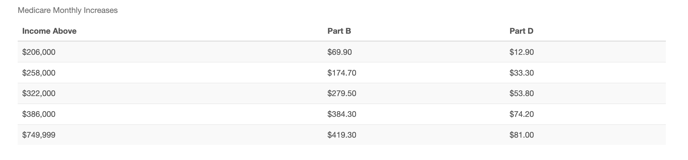

In 2024, an individual whose MAGI was more than $103,000 in 2022 and a married couple filing jointly whose MAGI was more than $206,000 in 2022 would be subject to the following Medicare Part B & D increases.

Tax Clarity illustrates Medicare thresholds by displaying a spike with an effective marginal rate of 100%. Each time the base effective marginal rate (green) dot moves past one of these spikes, the client's Medicare part B & D premiums will increase. The above thresholds will determine where the spikes are listed on the Tax Map.

Note: If your clients have Social Security earnings included in your report, the Medicare thresholds will not match the above mentioned thresholds. Social Security benefit taxes are not included in the base EMR as they are not taxable until other income causes them to be taxable. In this case, the thresholds will occur sooner. To validate that the spikes are happening at the right time, take the threshold minus 85% of the Social Security benefits entered.

You can view the total impact on Medicare premiums by clicking on the case "details" below the Tax Map.

Note: Medicare premium increases are not taxes in the traditional sense as they are not accounted for on the tax return; however, when Medicare premiums are included in the analysis, they will be added to the total tax.