While there is a penalty for claiming widow(er) benefits prior to full retirement age, it may be prudent to claim earlier in certain situations.

The earliest a widow(er) can start receiving benefits is at age 60. The claimant will need to be unmarried, unless remarried after age 60. The claimant cannot be entitled to a benefit higher than the benefit for which they are applying. In some instances, it may make sense to file for the survivor benefit early. Maybe the client needs the money or maybe their own record will be higher by delaying past full retirement age. The rules can get complicated and will vary from case-to-case.

Note: If a widow(er) has a disability, then benefits could start as early as age 50.

Filing for Survivor Benefits

The Social Security Administration (SSA) will need proof of the worker’s death and marriage certificate before you can file for survivors benefits. Divorced individuals will need to provide the final divorce decree. The Social Security Administration may also ask for the Social Security number, date of birth, date of death and place of death of the deceased. You can file at your local SSA office or by calling 1-800-772-1212.

Filing Prior to Full Retirement Age

Claiming early will reduce the widow(er) benefit by a fraction of a percent (71.5%-99% of the deceased worker's amount) for each month before full retirement age. This chart shows the monthly reduction percentage based on the claimants year of birth. Social Security Timing can help you calculate.

Using Social Security Timing to Help Navigate Widow(er) Benefits

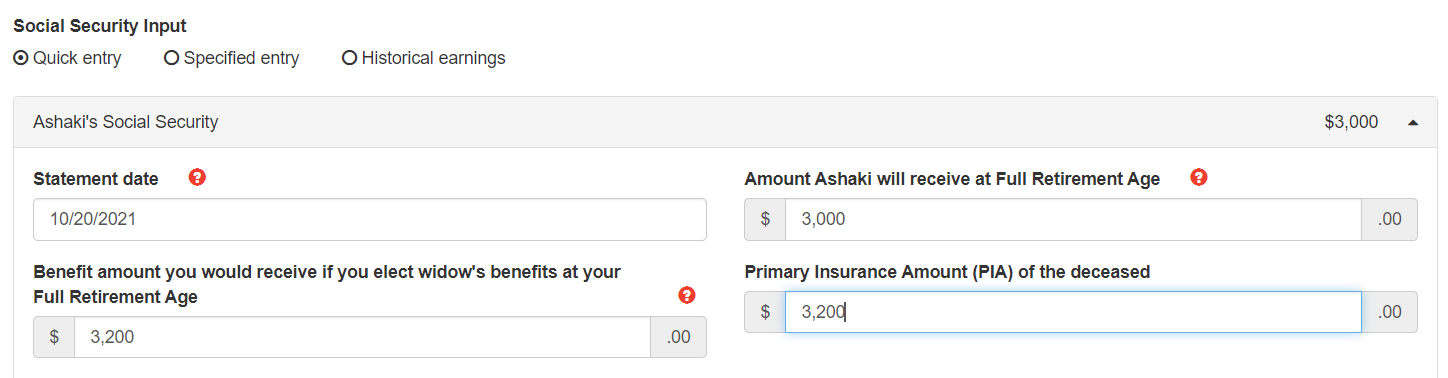

Aside from the client information you would normally need for running a case in Social Security Timing, you will also need answers to these questions.

- What amount would the client receive if they elect a widow(er) benefit at full retirement age?

- What is the primary insurance amount of the deceased?

To add this information click on the Social Security benefits folder on the client input page.

While the answer to these questions might be the same, but there are instances where the answers will be different. That would depend on if the deceased filed prior to death.

Tip: Clients can get the answers to these questions by contacting the SSA.