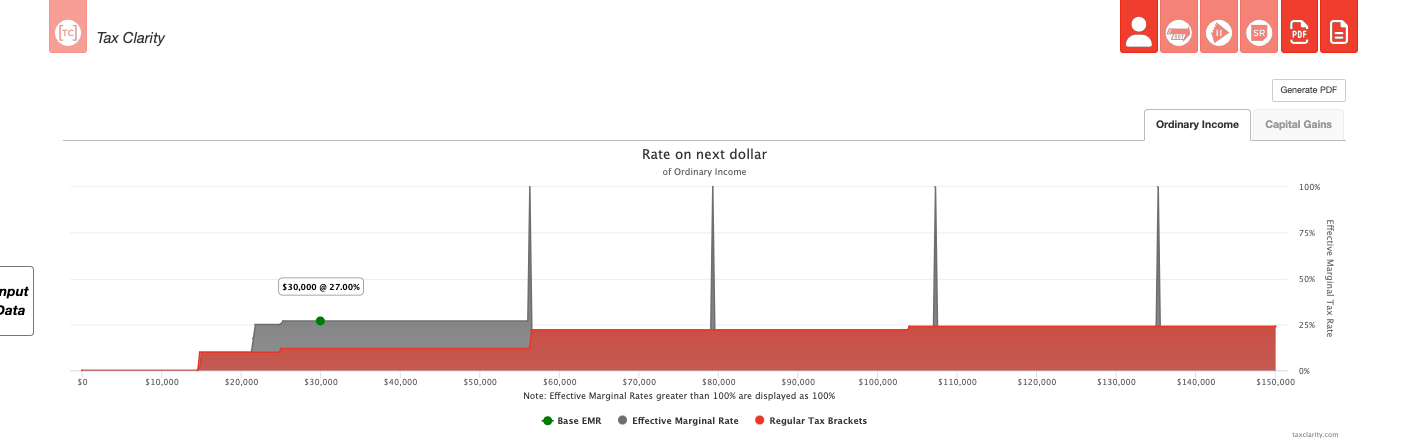

The effective marginal tax rate is not always the same as an individual's tax bracket. The effective marginal tax rate is the tax rate on the next dollar of ordinary income.

Marginal Tax Rate

The United States has a progressive tax system with tax brackets for standard ordinary income. This is referred to as the marginal tax rate.

| Tax Rate | For Single Filers | For Married Individuals Filing Joint Returns | For Heads of Households |

|---|---|---|---|

| 10% | $0 to $11,600 | $0 to $23,200 | $0 to $16,550 |

| 12% | $11,600 to $47,150 | $23,200 to $94,300 | $16,550 to $63,100 |

| 22% | $47,150 to $100,525 | $94,300 to $201,050 | $63,100 to $100,500 |

| 24% | $100,525 to $191,950 | $201,050 to $383,900 | $100,500 to $191,950 |

| 32% | $191,950 to $243,725 | $383,900 to $487,450 | $191,950 to $243,700 |

| 35% | $243,725 to $609,350 | $487,450 to $731,200 | $243,700 to $609,350 |

| 37% | $609,350 or more | $731,200 or more | $609,350 or more |

Effective Tax Rate

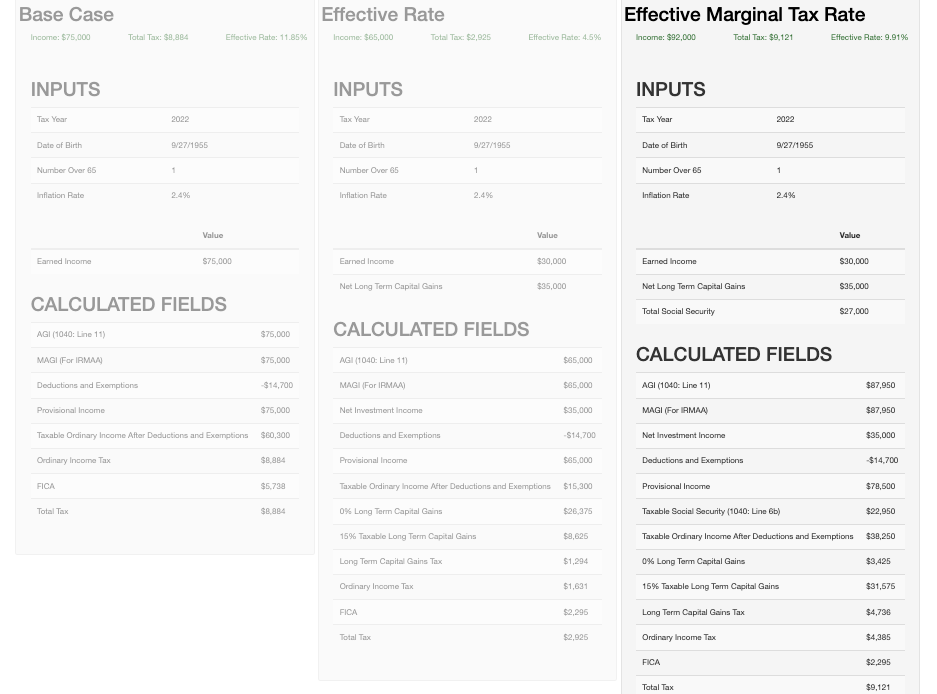

The effective tax rate is the total taxes you pay divided by the household's total gross income. It’s a blended rate after accounting for the standard deduction and the fact that some income falls into a 10% rate, some into a 12% rate, and some may even fall into a 22% or higher percentage rate. When you blend all those tax rates, you'll often find that the total taxes you pay are dramatically less than your tax bracket.Tax Clarity Displays Both the Effective Tax Rate and Effective Marginal Tax Rate

In Tax Clarity, the green dot represents the base effective marginal rate (EMR) for the data points used to generate the results. Below the Tax Map, you can see the details for calculating the effective and effective marginal tax rates.