Calculating Net Investment Income Tax

The Net Investment Income Tax (NIIT) went into effect on January 1, 2013 and applies at a rate of 3.8% to certain net investment income of individuals, estates and trusts. The tax is imposed on individuals with Net Investment Income and Modified Adjusted Gross Income (MAGI) over the following thresholds:

|

Filing Status |

Threshold Amount |

|

Married filing jointly |

$250,000 |

|

Married filing separately |

$125,000 |

|

Single |

$200,000 |

|

Head of household (with qualifying person) |

$200,000 |

|

Qualifying widow(er) with dependent child |

$250,000 |

Investment income includes, but is not limited to interest, dividends, capital gains, rental and royalty income, non-qualified annuities, income from businesses involved in trading of financial instruments or commodities and businesses that are passive activities to the taxpayer.

The NIIT of 3.8% appears in the Tax Clarity software on the Tax Map as an additional 3.8% added to a standard tax threshold. Example 24% + 3.8% = 27.8%

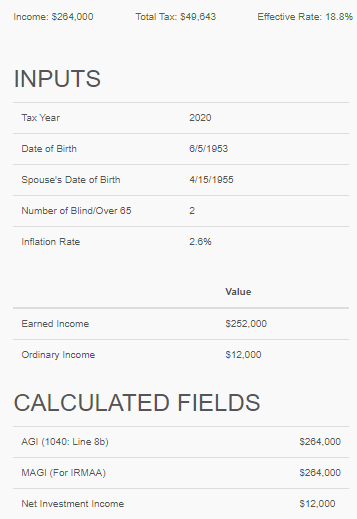

In the Details section NIIT appears underneath the MAGI.

Net Investment Income Tax Forms

- Individuals, estates, and trusts will use Form 8960

- For individuals, the tax will be reported on the Form 1040.

- For estates and trusts, the tax will be reported on the Form 1041.