A tax scenario your client may face in which the marginal tax rate they pay on their income exceeds their statutory tax rate.

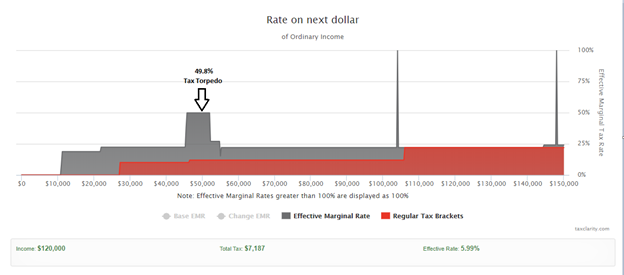

Within Tax Clarity reporting, the Tax Map will often show a significant increase in the Effective Marginal Rate (EMR) at certain income levels. For illustrative purposes, consider the case of a couple over 65 with a combined Social Security benefit of $65,000, net Long-Term Capital gains of $15,000 and Required Minimum Distributions (RMDs) of $46,000. In this instance, given the mix of capital gains, RMDs and Social Security benefits, the EMR shows a significant spike - the Tax Torpedo.

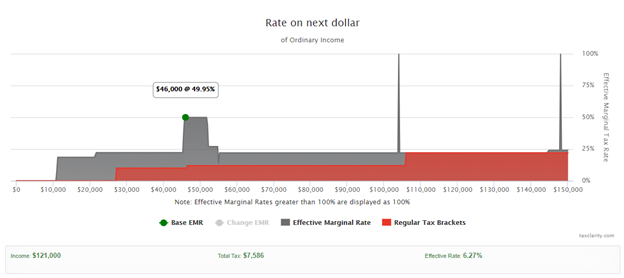

In numeric terms, for this example case, the map illustrates the impact. If the couple were to harvest an additional $1,000 in RMDs, the impact of the Tax Torpedo is clear.

- $1,000 additional IRA withdrawal taxed 12% bracket $120

- Causes $850 taxable social security taxed 12% bracket $102

- Causes $1,850 Capital Gains to be taxable taxed 15% bracket $277.50

- Total additional tax burden on $1,000 withdrawal $499.50

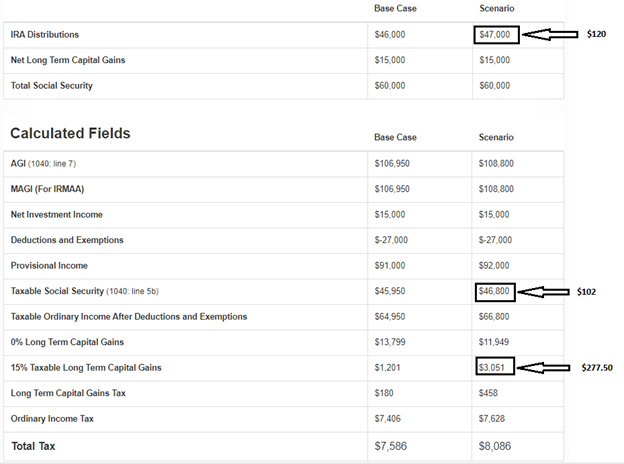

The Details tab in Tax Clarity will also show this information in a Base Case vs Scenario output:

Tip: Use this form to see a sample case that depicts the tax torpedo. Simply enter the figures from the form into the corresponding inputs in Tax Clarity and click "see results."