To account for typical end-of-life expenses passed through a Schedule A deduction.

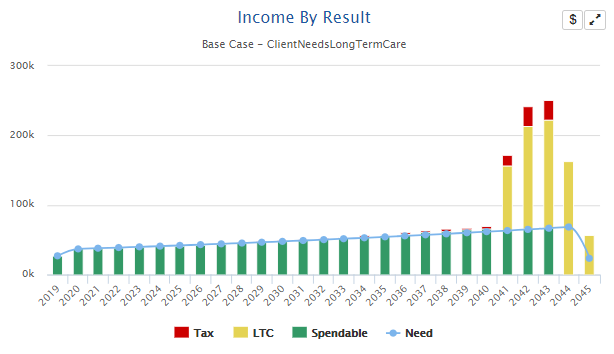

The Income InSight long-term care stress test applies a $4,000 per month expense for the four years prior to the end of the assumed client life expectancy. The additional medical expense is passed through as a Schedule A deduction in the analysis, creating a significant tax deduction (to the extent it exceeds a threshold of 7.5% or 10% of the client's adjusted gross income (AGI), depending on the tax year and client age). Oftentimes, the deduction will eliminate any federal income tax owed by the client. There are, however, some taxes that are payable regardless of the total Schedule A deductions.

Two primary examples are:

- FICA taxes on employment income, if there is spousal earned income.

- Medicare premiums for excess income (IRMAA or income related monthly adjustment amount), which are triggered based on the modified adjusted gross income (MAGI) before Schedule A deductions are applied.