The inflation stress test in Income InSight will show you how your clients' retirement strategies will be impacted by high inflation.

The Social Security Trustees still project 2.4% as the long-term average inflation. The inflation rate in Social Security Timing has a very low impact on strategy selection because the Social Security benefits are inflation adjusted.

Tip: Click here to view a chart of cost-of-living-adjustments from 1975-present.

It's difficult to accurately predict inflation. So, it’s important to make sure your clients’ retirement strategies remain strong even in a high-inflation environment. Income InSight can help.

Inflation Stress Test in Income InSight

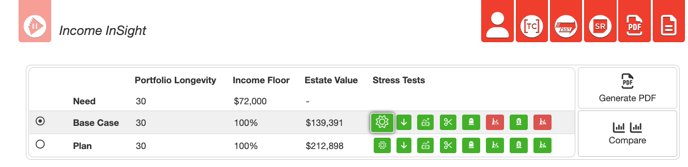

Rather than adjusting the base case assumptions for inflation or discount rate, you can use the inflation stress test in Income InSight to determine whether a high inflation rate would have a substantial negative impact on the plan overall. Some clients, such as those who have non-inflation adjusted pensions, will be more impacted than others.

An upwards-pointing arrow icon is used to indicate high inflation. A green icon indicates that inflation will not derail the strategy. If the client's retirement strategy cannot withstand 10 years of high inflation, the icon becomes red, and changes are needed. The software assumes 7.6% inflation per year for the first 10 years of the plan, requiring the same increases to after-tax income to maintain the living standard. This inflation rate is equivalent to the annual geometric average inflation from 1975-1984.