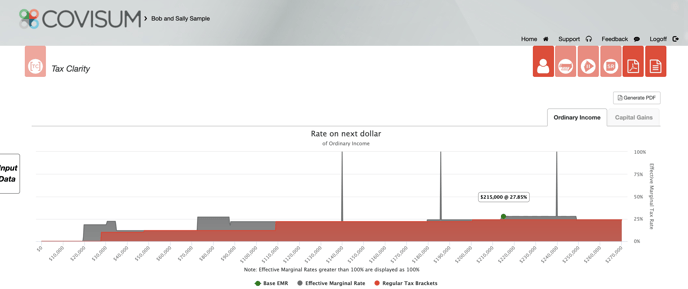

There are five common effective marginal rates in Tax Clarity: 15%, 18.5%, 22.25%, 27%, and 27.85%.

The effective marginal tax rate is the tax rate paid on each additional dollar of income over the threshold. The effective marginal rate is shown in gray on the Tax Map in Tax Clarity. The regular tax brackets are shown in red. The video below will explain effective marginal rates further.

Video Transcription

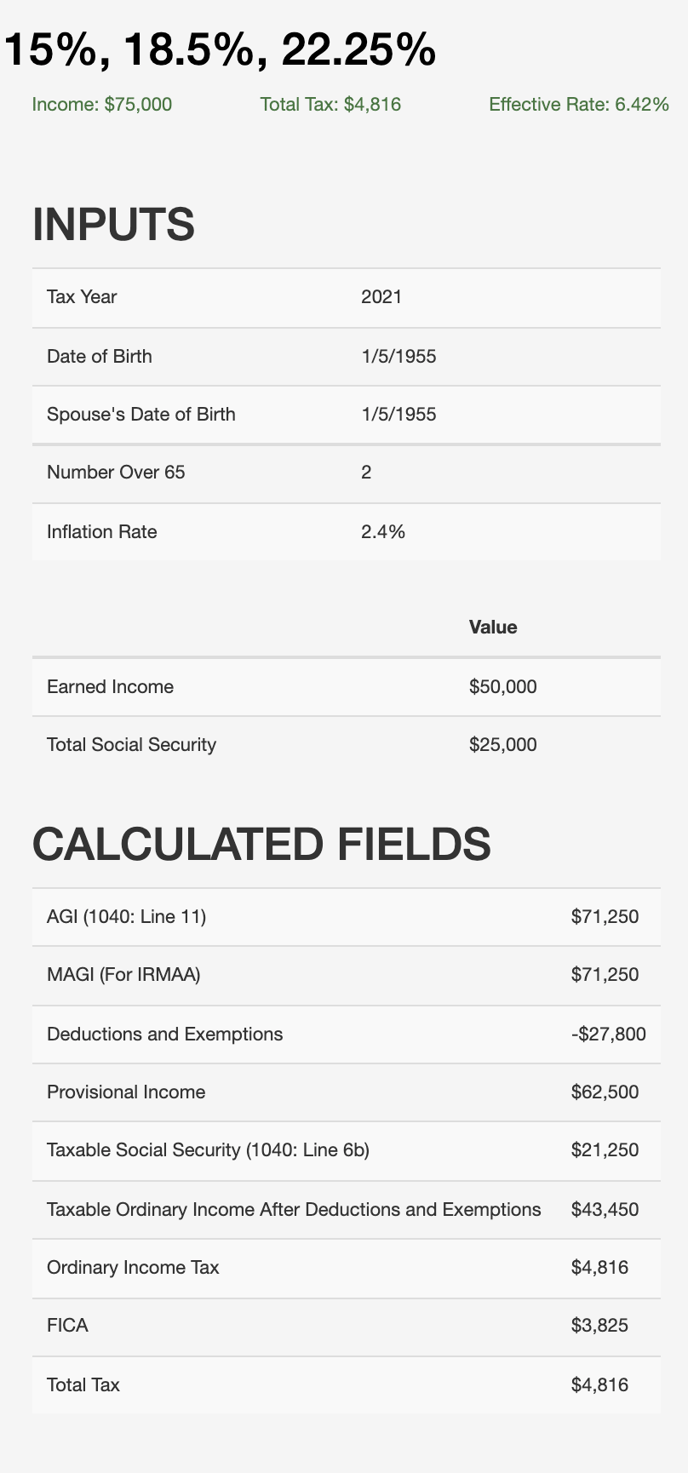

In this first scenario, we're going to look at the 15%, 18.5% , and 22.25% effective marginal rates. This is reflected on the graph in gray.

Note: Remember the gray is representing the interaction between all of our sources of income.

Why is Tax Clarity displaying a 15% effective marginal rate?

In this strategy, we have earned income and Social Security. We start by going to a 15% effective marginal rate, and you may be wondering how do we get to 15% rate when we have no 15% bracket right now. This occurs because your ordinary income is being taxed at 10%. At this point, you have enough income that you are now causing 50 cents of every dollar of Social Security to become taxable. It is taxed at the same rate as your ordinary income, which is 10%, but only 50 cents of every a dollar–half of 10 is five, so 15 is the 10% plus the 5%. At approximately $25,000 to $31,000, you are effectively giving up 15% tax on every dollar of ordinary income that you harvest.

marginal rate, and you may be wondering how do we get to 15% rate when we have no 15% bracket right now. This occurs because your ordinary income is being taxed at 10%. At this point, you have enough income that you are now causing 50 cents of every dollar of Social Security to become taxable. It is taxed at the same rate as your ordinary income, which is 10%, but only 50 cents of every a dollar–half of 10 is five, so 15 is the 10% plus the 5%. At approximately $25,000 to $31,000, you are effectively giving up 15% tax on every dollar of ordinary income that you harvest.

Why is Tax Clarity displaying a 18.5% effective marginal rate?

We then move into an 18.5% effective marginal rate. It is at this point that you have enough income that you are now dragging 85 cents of every dollar of Social Security into taxation. We're still in a 10% bracket. So 85% of 10 is 8.5. The client is effectively paying 18.5% tax on every dollar of ordinary income harvested from just over $31,000 up to about $37,000.

Why is Tax Clarity displaying a 22.25% effective marginal rate?

We then move into the highest threshold here at 22.25% . It is at this point that we have enough total income that we are being pushed into the 12% tax bracket. Ordinary income is being taxed at 12%. Social Security is still dragging 85 cents of every dollar, but now into a 12% bracket. And when you add that taxation together, the client is effectively giving up 22.25% to tax on every dollar harvested from this point to that point. When we drop down, it is because all of the Social Security that can be taxed will have been taxed.

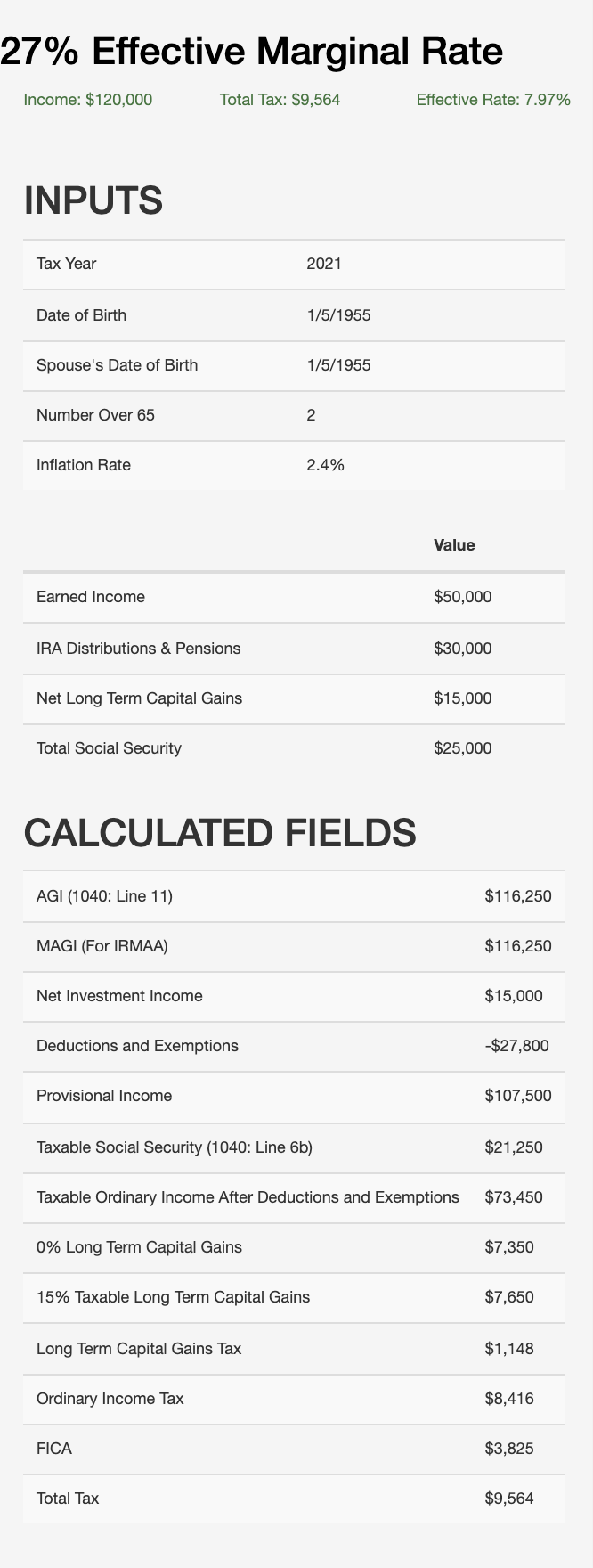

Why is Tax Clarity displaying a 27% effective marginal rate?

We move on to our next strategy. Here we'll see a 27% effective marginal rate. You're typically in a 12% ordinary income bracket, but at this point you have enough income that you are going to cause your capital gains to become taxable at 15% (15+12= 27). So from right about $72,000 to about $87,000, the client is effectively giving up 27% tax on every dollar of ordinary income that you harvest at this point. All of the capital gains that can be taxed will have been taxed, and the client drops into a regular of 22% bracket.

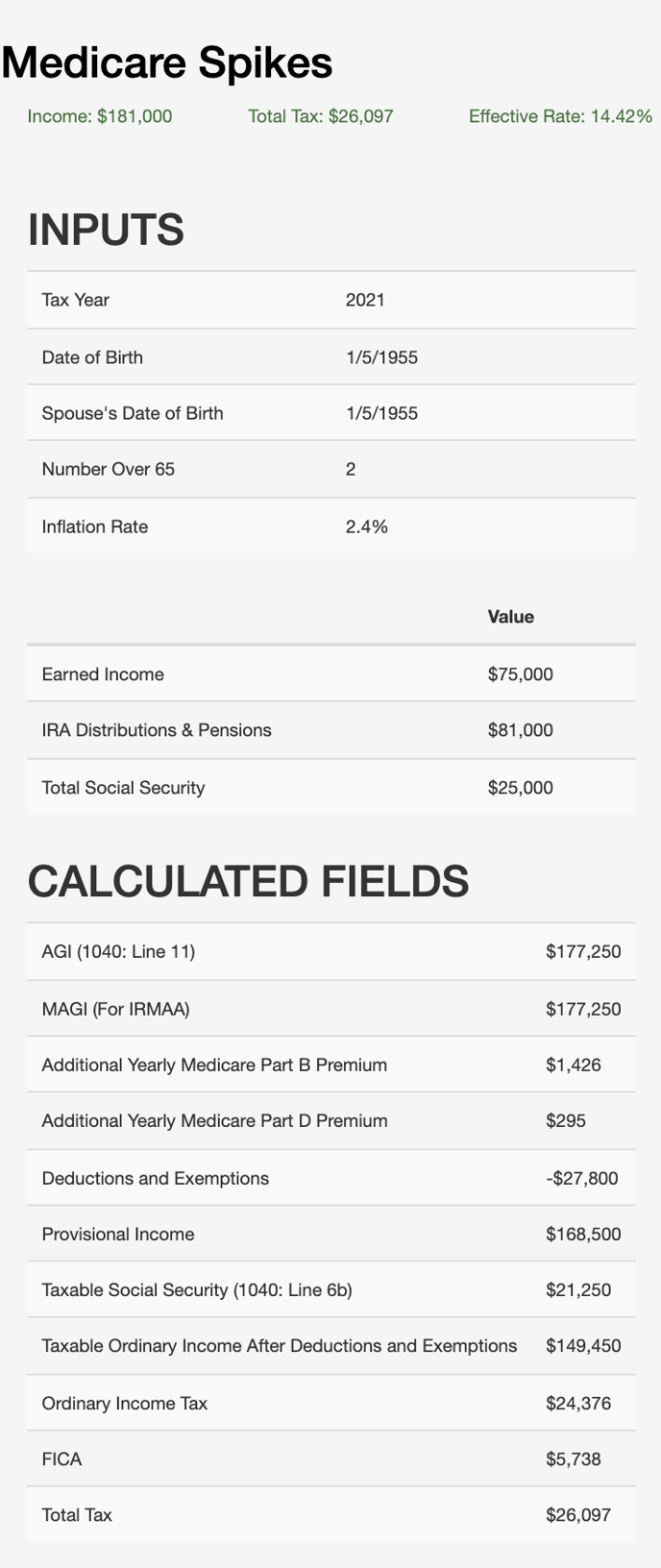

What are the spikes on the Tax Map?

We're going to take a look at these funny looking spikes. These spikes occur on cases where you have at least one person who is 63 or older. They are indicators for you, as the advisor. If we move our effective marginal rate past this point, there will be an increase in your client's Medicare premiums. Depending on how much income they have, you may not see any spikes at all. You could see four or five of them. Each time you move to the right, it is another increase in their Medicare premium. So in this scenario, we are to the left of that spike, I'm going to adjust my IRA distribution by $1,000, and we'll now be just to the right of that spike. When you scroll down and look at the calculated fields, you can see the additional part B and part D premium for your client. While the increase in Medicare will not occur for two years, we show the increase happening now for transparency.

have at least one person who is 63 or older. They are indicators for you, as the advisor. If we move our effective marginal rate past this point, there will be an increase in your client's Medicare premiums. Depending on how much income they have, you may not see any spikes at all. You could see four or five of them. Each time you move to the right, it is another increase in their Medicare premium. So in this scenario, we are to the left of that spike, I'm going to adjust my IRA distribution by $1,000, and we'll now be just to the right of that spike. When you scroll down and look at the calculated fields, you can see the additional part B and part D premium for your client. While the increase in Medicare will not occur for two years, we show the increase happening now for transparency.

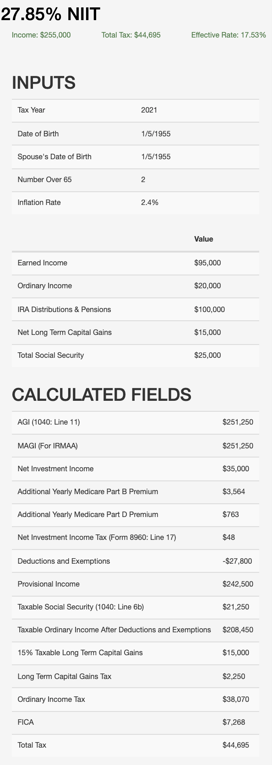

Why is Tax Clarity displaying a 27.85% effective marginal rate?

In our final strategy, we're going to look at how you arrive at a 27.85% effective marginal rate. This typically is seen once you start experiencing net investment income tax. Net investment income tax is an additional 3.8% tax on top of the ordinary income tax that the client is already paying. This depends on the sources of income and the amount of income that your client experiences.

rate. This typically is seen once you start experiencing net investment income tax. Net investment income tax is an additional 3.8% tax on top of the ordinary income tax that the client is already paying. This depends on the sources of income and the amount of income that your client experiences.