What is the Net Investment Income Tax (NIIT)?

Calculating Net Investment Income Tax

Net investment income (NII) is investment-related income reduced by expenses properly allocable to that income. NII is important because it may be subject to the Net Investment Income Tax (NIIT), a 3.8% federal surtax under Internal Revenue Code §1411. NIIT applies only when a taxpayer has net investment income and modified adjusted gross income (MAGI) above certain statutory thresholds.

NII generally includes interest, dividends, capital gains, rental and royalty income, nonqualified annuities, and income from passive activities. It does not include earned income such as wages. The tax is calculated as 3.8% of the lesser of net investment income or the amount by which MAGI exceeds the applicable filing-status threshold ($200,000 single or head of household; $250,000 married filing jointly or qualifying surviving spouse; $125,000 married filing separately).

Step-by-Step NIIT Calculation Example (Single Filer)

| Step | Description | Amount |

|---|---|---|

| 1 | MAGI | $270,000 |

| 2 | MAGI threshold (single) | $200,000 |

| 3 | Excess MAGI over threshold (Step 1 − Step 2) | $70,000 |

| 4 | Net investment income | $90,000 |

| 5 | Lesser of excess MAGI or NII | $70,000 |

| 6 | NIIT rate | 3.8% |

| 7 | Net Investment Income Tax owed (Step 5 × 3.8%) | $2,660 |

The NIIT is calculated on Form 8960 (Net Investment Income Tax) and carried to the taxpayer’s income tax return.

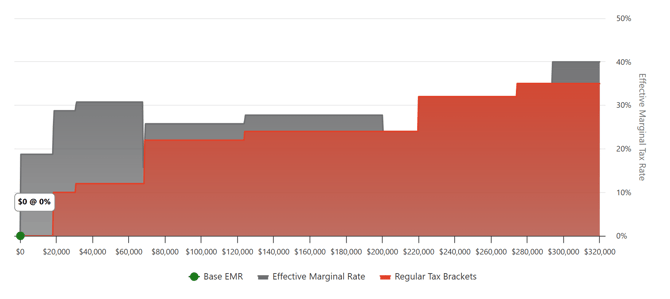

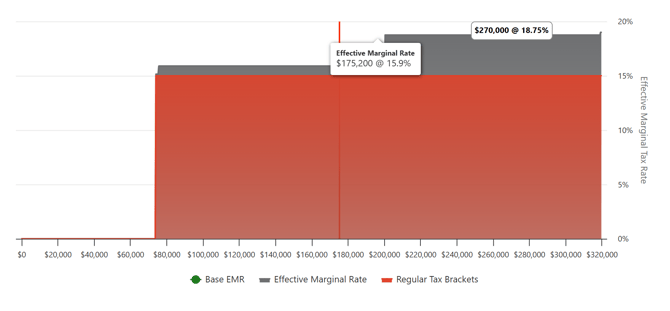

On the Tax Clarity Capital Gains Tax Map, we can see an effective marginal rate of 18.8%, which reflects the 15% long-term capital gains rate plus the 3.8% Net Investment Income Tax (NIIT). This same combined rate also appears on the ordinary income map—at 0% ordinary income, it is 18.8%, increasing to 28.8% at the 10% bracket, 30.8% at the 12% bracket, and so on.

At the 10% ordinary income level, an additional $1,000 of ordinary income can cause $1,000 of capital gains to be taxed at the 15% capital gains rate and another $1,000 of capital gains to become subject to the 3.8% NIIT, resulting in the higher effective marginal rate shown on the map.