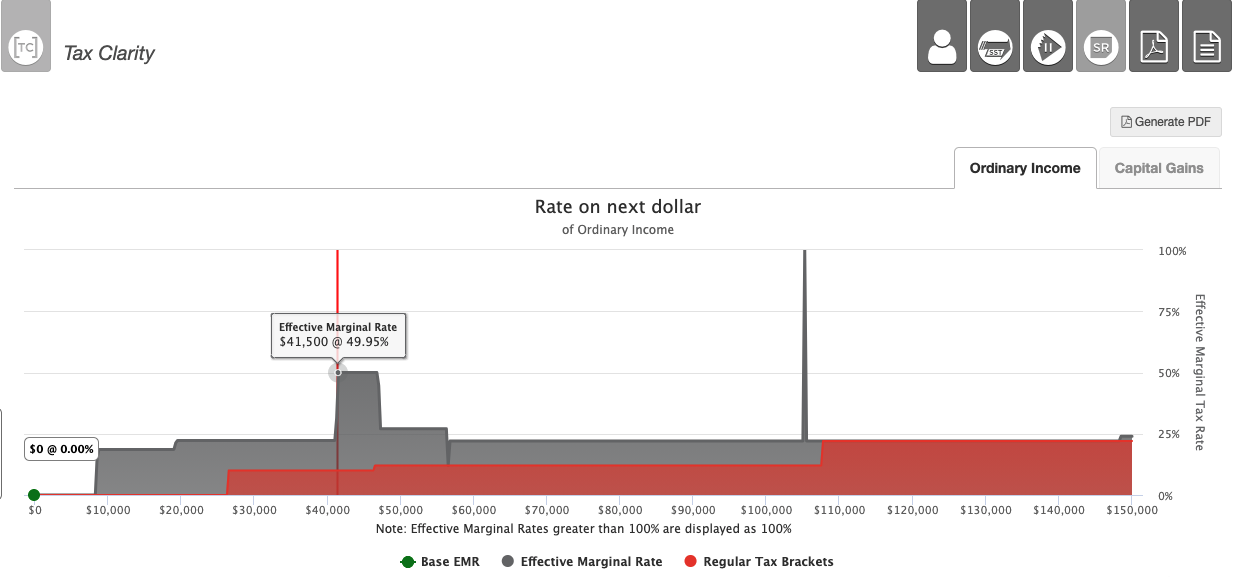

Tax Clarity allows you to quickly identify sub-optimal tax situations and show clients how to make retirement decisions in the most tax-efficient way. Calculate your client's effective marginal tax rate and identify dangerous points where just one additional dollar of income can push clients into much higher effective marginal tax rates.

Use Tax Clarity during every annual client review meeting to look at the tax landscape for any given year without creating a new case. Easily show the tax impact of different plan decisions. Compare different withdrawal strategies on-screen and save and communicate the results with your clients.

Yes! You can try Tax Clarity for free for 10 days.

Yes, we do. Learn how to use Tax Clarity in your financial planning practice by watching this recorded demonstration.

Yes! View our product tour to get a detailed walkthrough of some of Tax Clarity's key features.

A member of our customer success team would be happy to demo Tax Clarity for you. Choose the time and date that works best for you. Click here to schedule a live demo.

Choose the subscription that's right for you at $79.99/per month or $899/per year.

Your Tax Clarity subscription is intended for the sole use of one user, as outlined in our End User License Agreement (EULA). If you plan on utilizing our tools for multiple users, please reach out to sales@covisum.com for pricing.

Yes. Covisum powers some of the largest financial institutions in the United States. Contact sales for more information about our enterprise solutions.

Our data security statement is designed to answer the most common questions Covisum is asked in a vendor due diligence review and to provide supporting documentation for your file. Click here to access our data security statement.

Try Tax Clarity for free for 10 days with no obligation. Your 10-day free trial is designed to get you up and running with Tax Clarity.

Subscribe and unlock additional features and branding capabilities. Gain access to marketing materials. No contract required.

Helping you grow is why we’re in business. That’s why we provide practice management and marketing resources that align with your subscription.

Tax Clarity is a type of tax optimization software that allows financial advisors to identify sub-optimal tax situations, demonstrating to clients how to make the most effective and tax-friendly retirement decisions. By utilizing different scenarios, Tax Clarity can calculate the impact of current year Roth conversions or the harvesting of capital gains, predicting how those decisions will hit the return in terms of tax consequences and the effective marginal tax rate.

Tax Clarity allows financial advisors to conduct annual tax assessments based on factual tax data inputs, utilize comparative scenario analysis, and identify marginal tax rates and Medicare thresholds. A self-employment tax feature calculates the impact of paying both the employee and the employer's share of Social Security and Medicare taxes for self-employed clients. A pass-through tax feature demonstrates the impact of the deduction for pass-through income and the phase-out of the deduction under the 2017 Tax Cuts and Jobs Act, and a saver’s credit feature showcases the impact that the saver's credit may have on a client’s retirement income plan.

The effective marginal tax rate is the tax rate on the next dollar of income. It is influenced by individual circumstances including types of income, capital gains, benefit distributions, overall deductions, and more. It is often higher than the tax rate suggested by ordinary tax brackets.

Tax planning software can help determine a client’s effective tax rate and marginal tax rate. Effective tax rate refers to an individual’s average tax rate, or the percentage of their total yearly income that’s taxed. Marginal tax rate is the total amount of taxes that are added to any additional levels of income.

Many financial planning software programs assume that 85% of Social Security benefits will be taxed once the minimum income threshold is met, but that isn't always the case. The rate is variable depending on many factors. Tax Clarity can assist with these calculations to ensure your clients are prepared for their tax rates.

Access industry news, expert insights, best practices, free downloads and more.

© 2010 – 2025 Covisum®. All Rights Reserved. For advisor use only. Covisum is not connected with, affiliated with or endorsed by the United States government or the Social Security Administration. The local advisor offering Covisum products may be an insurance agent, financial advisor, accountant or attorney. Advisors may offer other products or services and are compensated by commissions and/or fees for any other services they may provide. Terms and Conditions | Privacy Policy