At the beginning of April, Covisum rolled out four new features to our Tax Clarity® software. The new Saver’s Credit feature allows an advisor to demonstrate the impact the Saver's Credit can have on a client’s retirement plan, which is particularly relevant for semi-retired clients who have choices on which accounts to draw from in order to supplement part-time work.

A case study

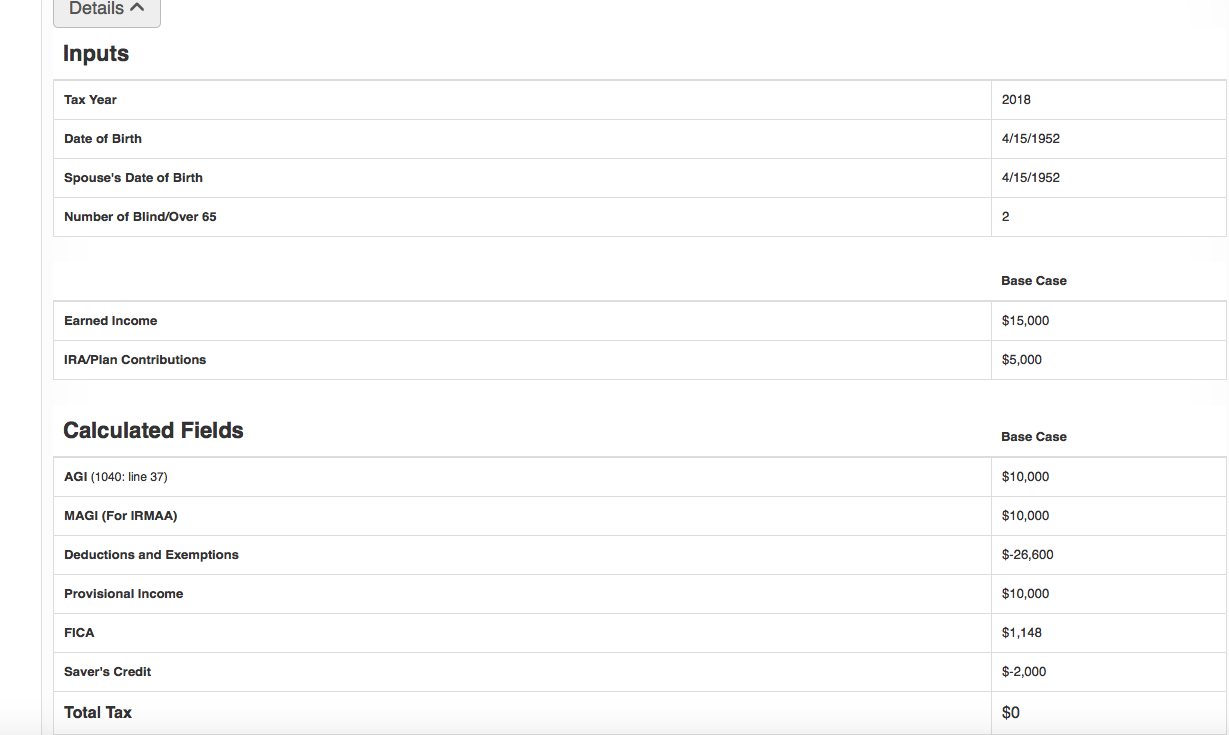

Let’s say your client has $15,000 of earned income through the course of a year from their part-time job and the rest of their income is coming from harvesting non-qualified money. Oftentimes, using non-qualified assets to supplement retirement income can be beneficial while delaying IRA income.

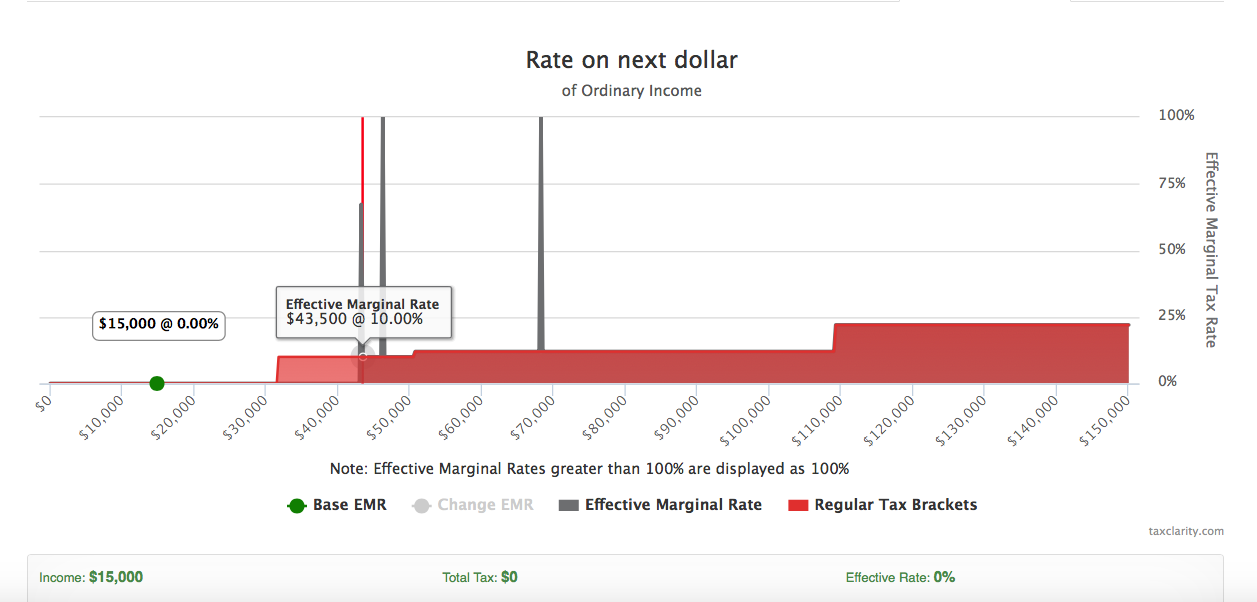

The spikes in the graphic above represent the phase out of the saver’s tax credit for someone who contributes to an IRA or defined contribution plan. For every dollar that an individual contributes below the first threshold of the Saver’s Credit, they will receive a tax credit for 50 cents. This is a significant tax credit, and you don’t want to go too high on the income spectrum and phase out that credit.

When you look into the Saver’s Credit details, you’ll notice this client is married and filing jointly. So, rather than have one client contribute $5,000, you’d want to split up the contribution so that each client contributes at least $2,000. That would allow the client to maximize the Saver’s Credit and get 50 cents on the dollar up to the maximum credit amount.

The new Saver’s Credit feature allows you to provide better service to your partially-retired clients, ultimately helping grow your business. Check out this blog for additional details about the other new updates to Tax Clarity®.

Making the best financial decisions is complex. Try Tax Clarity® today for free for 10 days and help clients visualize the new tax landscape and make better decisions about which income streams to use at which points in retirement.