SmartRisk Has Been Updated!

While market swings and economic downturns are a normal part of investing, the recent market volatility has caused many investors to feel uneasy and make impulsive decisions. That is why we've made major changes to our SmartRisk™ software.

The newly updated SmartRisk software makes it easier to show your clients and prospects their downside exposure prior to the next significant downturn. Use the software to estimate their potential loss, and prepare clients ahead of time for situations that are likely to create behavioral mistakes. With these software changes, you can help your clients better prepare for the next market dip and avoid panicking.

Investment Risk & Practice Management

As a practicing financial advisor, I've experienced, firsthand, the challenges that advisors are facing right now. Some clients are uneasy, and they are tempted to make poor investment decisions. They want their lifelong investments to last throughout their retirement, and they are worried they will have to sacrifice an important retirement goal or even un-retire.

As advisors, we've been taught how to "impress" clients with "complicated" scenarios that are, oftentimes, not actionable. I created Covisum to solve exactly these kinds of problems while benefitting both the advisor and the end client—the consumer.

Many of my colleagues and I have been repeatedly disappointed in the outputs from a major risk software provider. The software is expensive and the results are inaccurate. Using risk software without high quality risk metrics left egg on the faces of advisors and left clients in undesirable financial situations.

However, using a software with high-quality risk metrics makes a significant difference for your clients, especially during times of market stress. Good risk metrics allow you to build contingency plans before they're necessary—and a plan in place builds client confidence.

When markets are down, you earn your keep as an advisor and can prove that your planning process works.

I met with my clients early on when the market started to dip. Our revised strategies only included minor changes because we used quality risk metrics to create a contingency plan before the market took a turn.

What are Quality Risk Metrics?

SmartRisk uses heavy-tailed risk models that more accurately capture the frequency and impact of much more severe losses in financial markets than the more commonly used Gaussian distribution (also known as normal distribution, which typically holds true for events in nature, but not financial markets). "Heavy-tail" simply means that there is a larger probability of getting exceptionally large values. An increasing variety of outcomes are being identified as having heavy-tail distributions, including income distributions, financial returns, and insurance payouts.

Using estimated tail-loss methodology, like we use in SmartRisk, provides a much better estimate of possible downside exposure.

Covisum's SmartRisk has always utilized high-quality risk metrics, heavy-tail distributions and estimated tail-loss methodology. However, these terms are complicated and consumers don't always understand market variations and the algorithms used to evaluate their investments.

The fact is, high quality risk metrics are complicated. But the reporting doesn't have to be. Covisum has been hard at work finding that sweet spot where advisors and clients don't find themselves in a vulnerable position to fail, but without so much to analyze that they wind up with paralysis by analysis.

What's New with SmartRisk

With the recent market dip we've updated our software to make it easier to use than ever. Simplicity is key. Here's what's new:

- NEW fee comparison chart—quickly and easily show clients the fees in their portfolio relative to other similar holdings.

- A more complete universe of securities coverage.

- Updated client-friendly reports with actionable graphics

- NEW on-demand consumer-facing video series portfolio risk

- Exclusive investment risk consumer-facing marketing kit

If you've never tried it before, take a 10-day free trial, no credit card required, and see for yourself. If you're a current SmartRisk subscriber, you already have access to all of these new solutions. If you subscribe to other Covisum tools, it's super easy to add SmartRisk.

Making Risk Inputs Simple, Keeping Reports Actionable

Everyone is talking about the market and the economy. You've likely had numerous conversations about risk and risk tolerance lately.

Start with a native import of all of your client's holdings from TD Ameritrade. Our new FinMason integration utilizes a faster and better universe of securities, so you get a more robust analysis back faster. Keeping it simple.

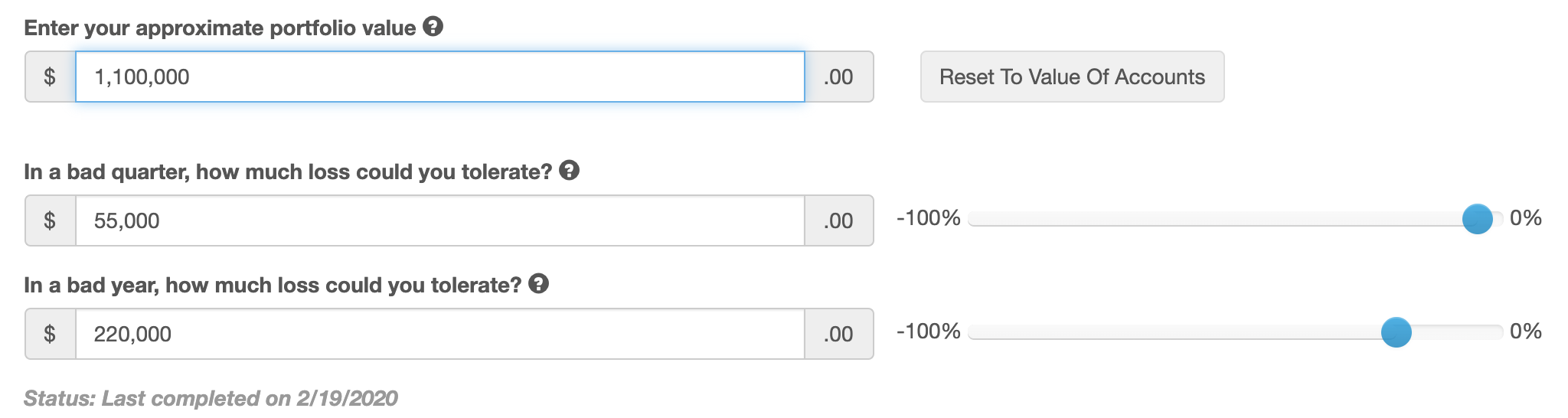

Next, you can easily accommodate risk tolerance in SmartRisk with our client-friendly risk questionnaire. Just ask two questions and click next. Remember: simple.

If you have a more elaborate questionnaire that is part of your practice, SmartRisk won't overcomplicate things for you or your clients.

Use SmartRisk's easy diversification index graph and side-by-side comparison features to demonstrate their base case right next to their reallocated plan case. SmartRisk's diversification index graphic will clearly demonstrate whether your clients investments are diversified, focused, or hedged.

Using SmartRisk to Have Conversations About Market Volatility

The current market volatility can be a catalyst for client conversations about risk. You can also use it as an opportunity to attract new clients. As part of our SmartRisk revamp, we've also built a comprehensive marketing kit to help you communicate with prospects and clients to grow your practice.

The kit features five steps to get started now, marketing email templates and graphics, consumer-facing webinars, a guide to marketing on Facebook, PowerPoint presentations that lend themselves to either live or on-demand client webinars, and a slew of other downloads, templates, videos, and tips. These materials are exclusively available to SmartRisk subscribers.

With SmartRisk, you can attract new prospects, analyze portfolio risk and easily communicate with clients to help them avoid costly mistakes. Retain clients during a down market and help prevent them from making costly investment mistakes. Use SmartRisk to quickly and easily showcase and market your expertise.