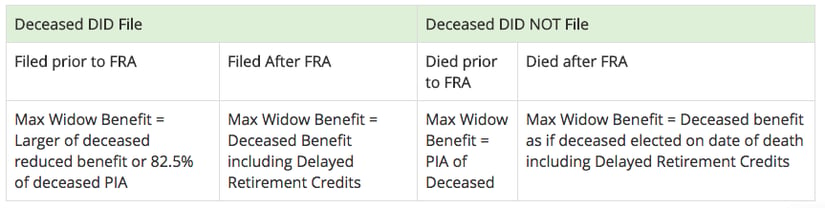

Most of you are probably already familiar with a simplified version of the widow calculation which says that the surviving spouse receives the higher of his or her own benefit, or the benefit of the deceased, which may have been reduced or increased depending on if and when the deceased filed for Social Security benefits. See Figure 1 below.

But there are several layers of complexity to the Widow(er) Benefit that make it difficult to determine whether to claim Widow(er) Benefits early, when to wait, and when to switch to the survivor’s own benefit when conducting Social Security planning. There are actuarial reductions for the widow who claims early and a Widow Limit, which we’ll get into in a moment. The good news is Social Security Timing® includes a Widow Calculation so you can run scenarios for your widowed clients and help them determine when to claim benefits.

Get started now with a FREE trial of Social Security Timing!

Widow Options

Now let’s get into some of the complications you’ll be dealing with when advising a widowed spouse on when to elect Social Security benefits.

There are 3 main complicating factors when dealing with the Social Security Widow Benefit:

- Two Different Full Retirement Ages — Widows actually have two different FRAs: their Retirement FRA and their Widow FRA. For most people getting ready to elect Social Security today, their Retirement FRA is 66. Their Widow FRA is determined by subtracting two years from their date of birth and using that as their birth year in the standard FRA table. There is no advantage to delaying Widow(er) Benefits past the Widow’s FRA as there are no delayed retirement credits based on the Widow’s claim age.

- Actuarial Reductions — The surviving spouse can begin receiving Widow(er) Benefits as early as age 60. However, those benefits will be reduced up to a maximum of 28.5% due to claiming early. To determine the monthly reduction amount, simply take 28.5% divided by the number of months between age 60 and the Widow FRA determined in No. 1 above.

- Widow Limit — The Widow Limit caps the Widow(er) benefit at the larger of the benefit the deceased would have received if he or she were still alive, or 82.5% of the deceased PIA. The Widow Limit only comes into play if the deceased claimed benefits prior to his or her FRA.

Let’s look at an example that takes these complications into account.

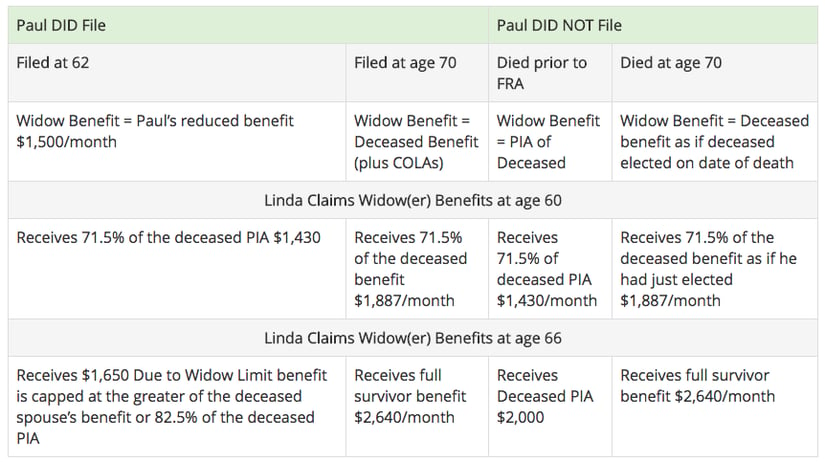

Let’s say Linda is your client. Her husband Paul passed away when she was 60. Let’s assume that Paul had a PIA of $2,000. The Widow Benefit Linda could receive is based both on when Paul claimed and when Linda decides to claim that benefit. So let’s look at a variety of scenarios to illustrate how Linda’s widow benefit will be affected. Figure 2 illustrates.

- If Paul died at 66 and never elected, Linda would be able to claim up to the full $2,000. If Linda were 60 when she claimed, she would receive 71.5% percent of the benefit, or $1,430 per month. If she waited until age 66 to claim, she would receive the full $2,000.

- If Paul claimed at 62 and was receiving $1,500 (75% of his PIA) per month until his death at age 66, Linda would only be entitled to up to $1,500 under the basic rule outlined above. However, in this case, there is another provision that would impact her benefit amount. It is known as the “Widow Limit,” which caps widows’ benefits at the higher of the amount of the deceased spouse’s benefit, or 82.5% of the deceased spouse’s PIA. If Linda elected her widow’s benefit at age 60, she would still receive the maximum reduction—down to $1,430 per month—but if she waited to 66, the most she could receive is $1,650, not the entire $2,000. In this case, Linda would not want to delay taking her widow’s benefit for any more than 28 months (to age 62 and 4 months) because it would not increase any further due to the Widow’s Limit.

- If Paul began receiving Social Security at age 70, his benefit would have been $2,640. If he died one month later, Linda would receive up to $2,640, provided she claimed her Aged Widow’s benefit at 66, or $1,887 per month if she claimed at age 60.

Manipulating Widow Benefits

If you receive Widow(er) Benefits, you may also switch to your own retirement benefits as early as age 62, assuming the amount will be more than you receive on your deceased spouse’s earnings. In many cases, you can begin receiving one benefit at a reduced rate and then switch to the other benefit at the full rate when you reach full retirement age. And you can take a reduced benefit on one record and later switch to a full benefit on the other record. For example, a woman could take a reduced Widow’s benefit at 60 and then switch to her own retirement benefit when she reaches full retirement age. Or she could continue to get delayed credits on her own record past full retirement age and switch to her own benefit at age 70.

It is of critical importance to understand that no Switch Strategies will be allowed unless the Widow(er) restricts the scope of the initial application.

The ability to run these calculations and find the best possible election strategy is obviously incredibly important to your widowed clients when developing Social Security planning. These scenarios could also be enlightening for your married clients to show what electing early can do to survivor benefits.