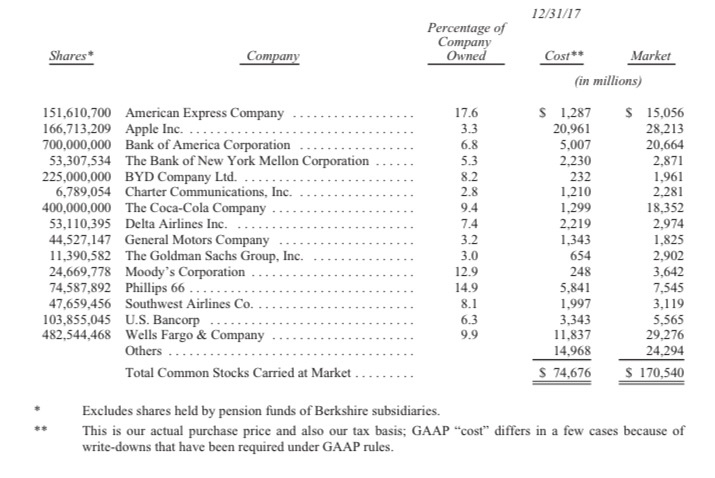

Our in-house risk expert, Ron Piccinini, PhD plugged this well-known portfolio into SmartRisk (excluding the "others" portfolio). What did he find?

How do your clients' portfolios stack up? Find out for free with a 10-day trial of SmartRisk.

Access industry news, expert insights, best practices, free downloads and more.

© 2010 – 2026 Covisum®. All Rights Reserved. For advisor use only. Covisum is not connected with, affiliated with or endorsed by the United States government or the Social Security Administration. The local advisor offering Covisum products may be an insurance agent, financial advisor, accountant or attorney. Advisors may offer other products or services and are compensated by commissions and/or fees for any other services they may provide. Terms and Conditions | Privacy Policy