We are well into February, and we’ve reached the perfect time of year to schedule annual reviews for your clients who are still working. There are some opportunities for clients with earned income to clean-up before April 15. One of the most basic ways is through IRA contributions. You can use Tax Clarity® to identify opportunities where IRA contributions can be used to reduce the amount of taxable capital gains.

Case Study: John and Jane Doe

Your clients, John and Jane Doe, are a married couple filing jointly; both are over 65 years of age. They have $65,000 in IRA withdrawals, $15,000 of work income, and $50,000 of realized capital gain.

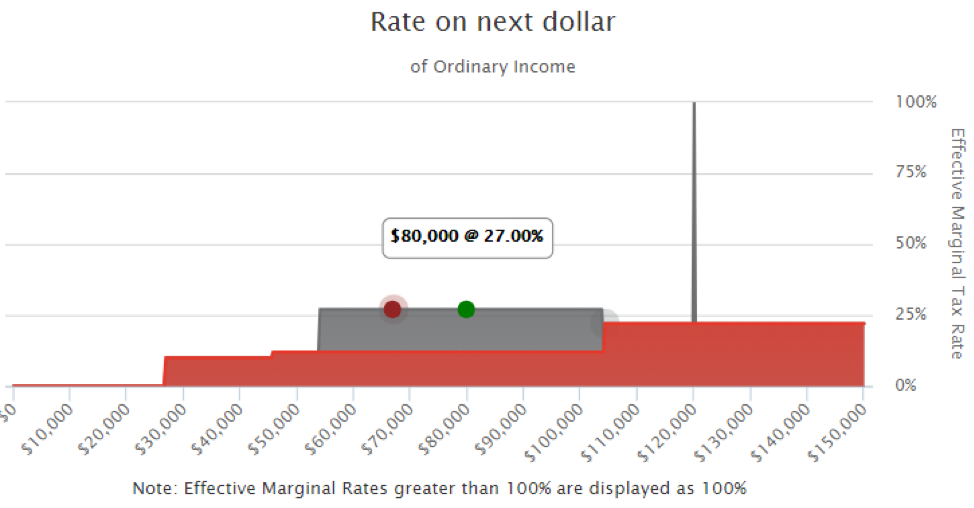

After entering the information into Tax Clarity, this Tax Map is displayed.

The gray area on top of the red area highlights an interaction. In this case, we have an interaction between ordinary income and capital gains. So, if you take an extra dollar of the $80,000 of ordinary income out of this client’s IRA, they’re actually going to lose 27 cents of that dollar to federal income tax. Not only is that dollar of IRA taxed at a 12% rate, but it creates 15 cents of tax on a capital gain dollar that would’ve otherwise fallen into a zero percent bracket.

In other words, if a client has long-term capital gains that are not entirely taxable, you have an opportunity to double dip with an IRA contribution. Since this couple falls between 65 and 70 years of age, there is an opportunity for both of them, even though only one is working. Therefore, when you make a $13,000 IRA contribution, you’re not just saving the 12%.

To talk taxes with clients, you don’t have to know all of the complicated interactions between different tax provisions and different types of income. Use the software to showcase your value as a financial advisor and carefully plan your clients' retirement income, manage withdrawals, and minimize income taxes while gaining insight into unseen opportunity to add dollars to a retirement plan.

Subscribe to Tax Clarity and identify other sub-optimal situations to help you show your clients how to make retirement decisions in the most tax-efficient way, prior to April 15. It’s easy to get started, follow this quick five step process.

- Step 1: Register for a no obligation free trial of Tax Clarity.

- Step 2: After you register for a free trial, our customer support team will contact you to schedule a 30-minute training call.

- Step 3: Following the customer success call, most advisors are up and running in Tax Clarity in a couple of hours. There are also on-demand training videos available within the software.

- Step 4: Start adding client information and generating Tax Maps using Tax Clarity.

- Step 5: Log into your account and click on the buy now button.