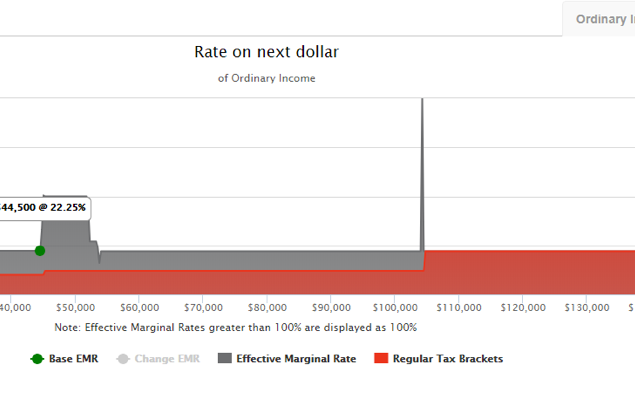

Identify Tax Opportunities

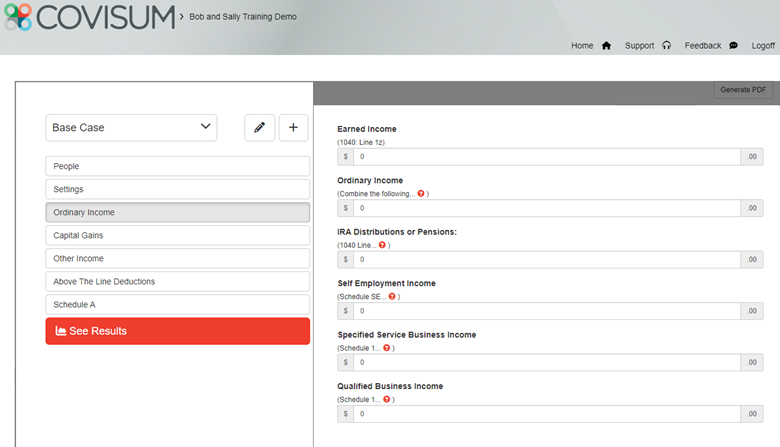

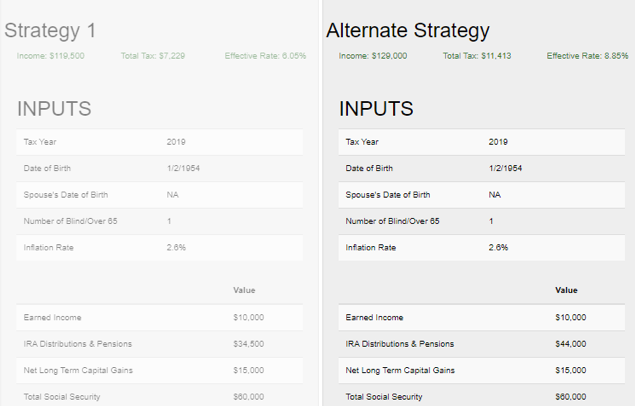

Our Tax Map allows you to run alternative scenarios in comparison to the base effective marginal rate. Tax Clarity also offers features to compare the tax impacts of self-employment, pass-through income, and the saver's credit.