At the beginning of April, Covisum rolled out four new features to our Tax Clarity® software. The new self-employment tax calculates the impact of paying both the employee and the employer's share of Social Security and Medicare taxes for self-employed clients.

This feature includes three new input boxes:

- Self-employment income

- Specified service business income

- Qualified business income

Under the Tax Cuts and Jobs Act, any self-employment income falls into one of two categories:

- Specified service business income

- Qualified business income

The difference between the input for the specified service business income (income from a specified trade or business, or STOB income) and the qualified business income input is the cap.

The purpose of Tax Clarity® is to identify financial planning opportunities. Calculations relating to specified service business income or qualified business income should be done by a CPA. You can find resources to help you build relationships with CPAs in the settings tab when you are logged into Tax Clarity®.

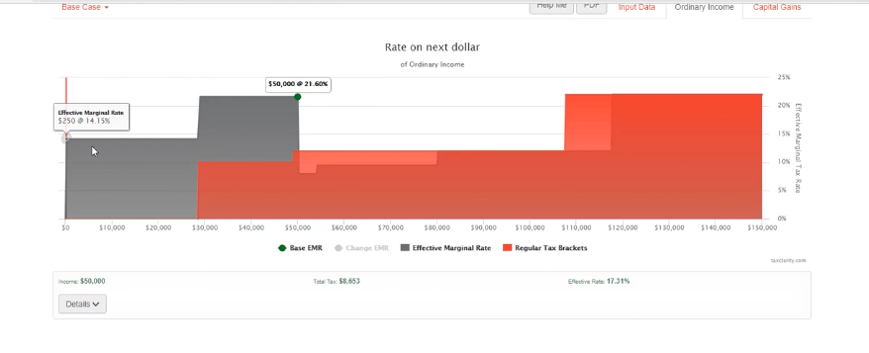

For the case above, $50,000 was added to the specified service business income field. You’ll notice right away that this client's self-employment income is not subject to any standard deduction. The 14.15% tax rate is applied to the first dollar of self-employed income.

Self-employment tax is 15.3%, but you’ll notice the software says 14.15%-why is this?

The 15.3% calculation represents 7.65% for the employee (comprised of 6.2% Social Security tax and 1.45% Medicare tax). The employer pays the same amount.

It’s the same for a self-employed person. The only difference is when you calculate the self-employment tax, you’ll notice on line four of Schedule SE, the total amount of self-employment income is multiplied by .9325. The portion that would have been paid by an employer is not included in the calculation. So, the net rate that a self-employed individual is actually paying on self-employment tax is actually closer to 14.15%.

Clients who have retired but continue to do consulting work (specified service business income)

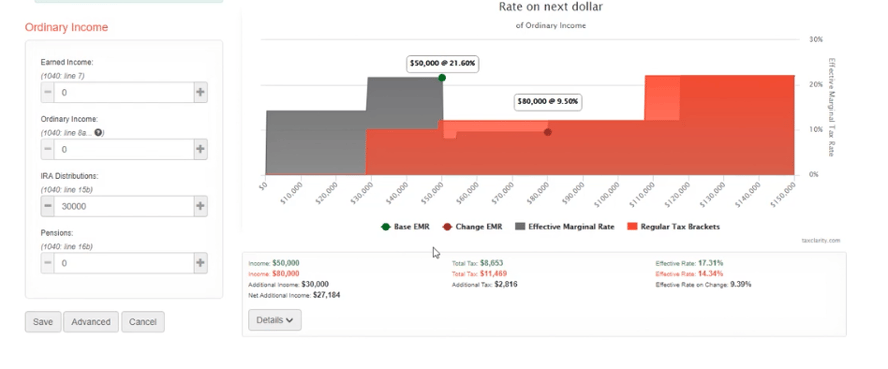

The Tax Clarity® update shows opportunities for self-employed clients to convert to a Roth or to harvest IRA income at a lower rate.

In this case, the amount paid on the next dollar drawn from an IRA, or other ordinary income that’s not employment income, is actually below the bracket rate. This might be an opportunity to do Roth conversions. In this case, you can move up to $80,000 from $50,000 and still be below the bracket rate. Your client might want to take an extra $30,000 out of an IRA to supplement spending needs or possibly convert it to a Roth. Your client would pay 8% on some and 9.5% on the rest. The 20% deduction for self-employment income would have occurred earlier, but with no ordinary income to count it against, it applies here.

The new self-employment tax feature allows financial advisors to provide better service to the growing number of older Americans who are classified as self-employed, ultimately helping grow your business. Check out this blog for additional details about the other new updates to Tax Clarity®.

Making the best financial decisions is complex. Try Tax Clarity® today for free for 10 days and help clients visualize the new tax landscape and make better decisions about which income streams to use at which points in retirement.