Many advisors have a variety of financial planning software solutions to help them meet their clients' needs. There is software to help you create and organize your client database, manage portfolios, optimize Social Security benefits, market your practice, and more. But relying on several different tech tools can cause some headaches. They may claim to integrate, but how well do they? It's not enough to share data. The software also needs to share assumptions, or outputs will be hard to reconcile and, at worst, contradictory. Financial planning software should seamlessly integrate so that you can move from one tool to the next. Enter Income InSight®.

Better Retirement Income Planning

Income InSight is a complete retirement income planning platform that allows you to look at each aspect of the client's strategy and their strategy as a whole. You can help clients determine when to claim Social Security benefits. You can see how taxes will impact their retirement. You can help prepare clients for market fluctuations and more. You can be prepared to answer your client's most important questions quickly and easily and guide them on their retirement journey.

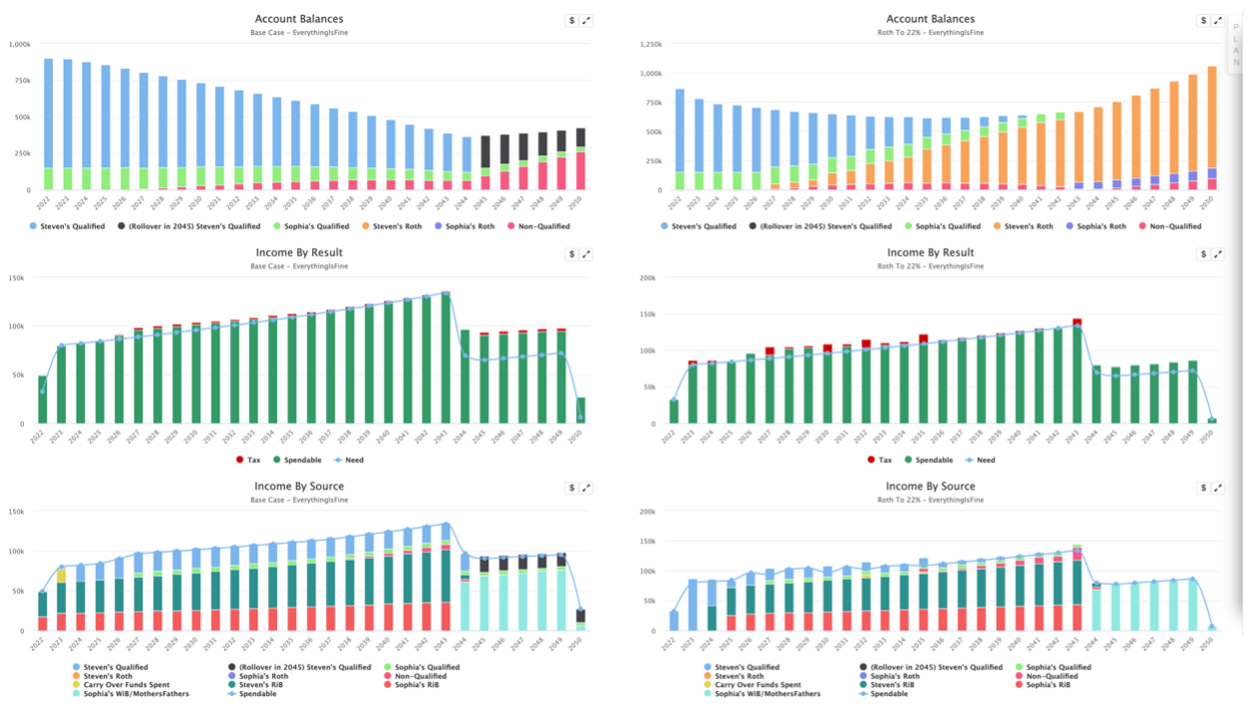

Retirement income planning is more straightforward with Income InSight. Clear and simple-to-read charts show clients their account balances, income by source, and income by result. Everything is in one place, so it's easy to take a holistic approach to retirement income planning. The software displays the client’s retirement income sources like earned income, retirement accounts, and tax free-income sources such as disability income, so it’s easy to highlight which income sources they should use at different points in retirement.

Plus, with a multi-year Tax Map, you can show clients what their tax landscape looks like now and in the future. Use the Tax Map to influence which account you pull from and when so clients don't get slammed by unexpected taxes.

Sign up for a free trial of Income InSight now.

Roth Conversions

It's no secret that converting dollars from a traditional IRA to a Roth IRA is often a smart tax-saving strategy for retirees. Income InSight simplifies Roth Conversions by allowing you to convert up to the 24% bracket, the client’s lifetime effective marginal rate, or chose a custom conversion percentage. The Roth conversion features in Income InSight are precise and easy to use, so you can help more clients take advantage of this strategy.

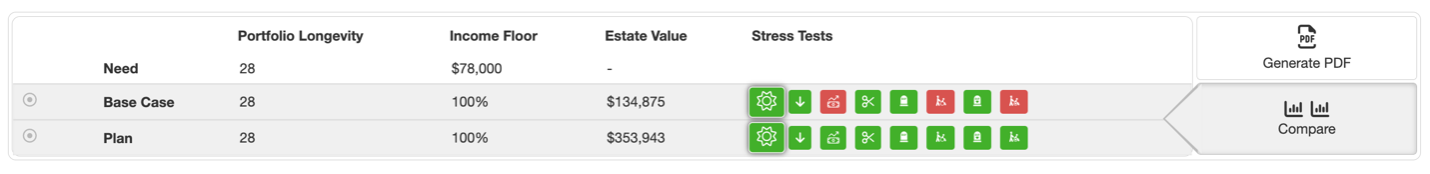

Test The Retirement Strategies You Recommend

The easiest way to tell if the retirement strategy you recommend works is to test it! The stress test icons in Income InSight allow you to quickly see if your client's strategy will survive various stressful circumstances. For example, are your clients worried about the impact of high inflation on their retirement? Check to see if the upwards-pointing arrow icon is green. If it is, your client's retirement strategy can withstand 7.6% inflation per year for the first ten years of the plan. (This inflation rate is equivalent to the annual geometric average inflation from 1975-1984.) If the icon is red, you can adjust the plan and test it again. You can test the strategy against a down market, cuts to Social Security benefits, a long-term care need, or an early death.

Get Started

Designed by advisors for advisors, Income InSight has everything you need to create a comprehensive retirement income strategy. The software makes it easy to help clients make intelligent retirement decisions. Plus, you can compare two different retirement strategies side-by-side, demonstrating the value of your services. In addition, all subscribers receive access to marketing materials, including emails, videos, graphics, and a retirement income planning presentation to help you attract new prospects.

Try the software for free for 10-days; no credit card is required.