Marketing

Ask Our Director of Marketing: Q & A on Generating Leads for Your Financial Planning Business

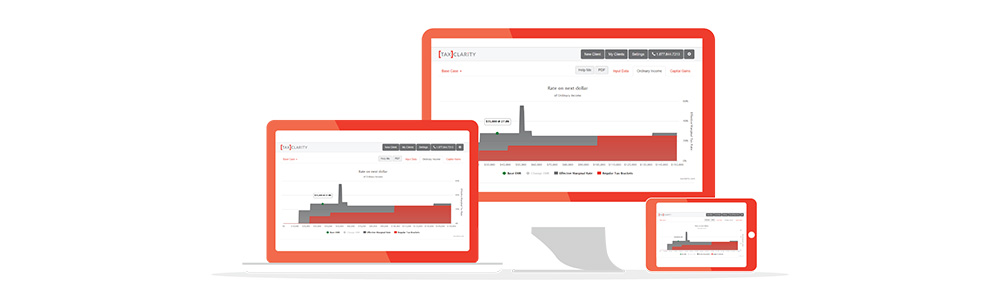

Sometimes, advisors who are considering a subscription to Covisum software have questions about how to use our tools and resources to market their financial planning business. Our tools can make a big impact for financial advisors — especially those serving mass-affluent retirees and those in retirement transition. Financial advisors and institutions rely on Covisum’s software, resources and successful marketing tactics to streamline their practices, offer actionable insights and guide clients to make the best financial decisions. This week, an advisor evaluating our software asked Katie Godbout, Covisum's Director of Sales and Marketing, a question about lead generation and inspired her to write this post.

Read