When the first clients were introduced to our model, they saw the fit was so tight they nicknamed it the “glove.” Our model leverages cloud technology, which allows us to unleash tremendous computing power. This computing power allows us to discard the simplifying assumptions that were previously embedded in older models, freeing the data to speak for itself.

Risk Model Description

For single-name securities (Equities, ETFs, Mutual Funds), the model uses two sub-models to estimate risk: (i) a statistical model fitted to historical returns series (look-back), and (ii) a projection of potential future price movements based on the option implied volatility surface of that particular underlying security, where available.

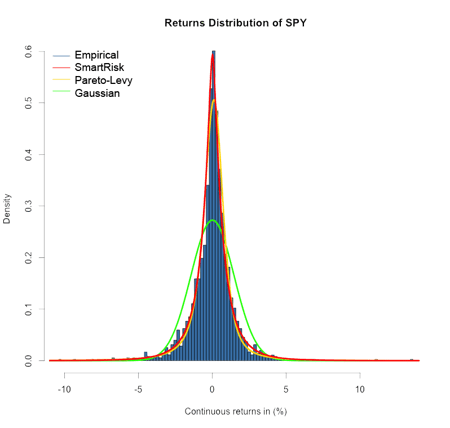

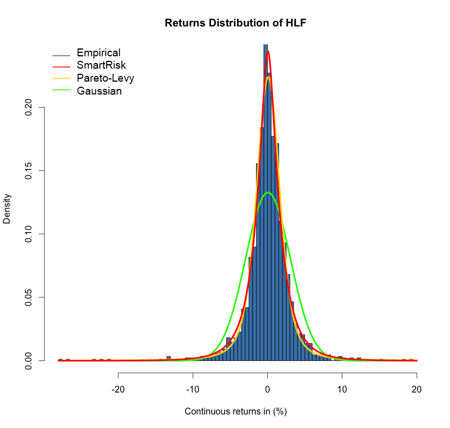

(i) The Historical Model: The workhorse statistical distribution used to model risk, whether for individual securities or portfolios is proprietary. In its simplest form, it is a three-parameter “heavy-tailed” distribution that has shown to provide overall superior fit to financial data (especially in the tails), compared to other well-known heavy-tailed candidates, such as the Student-t, Pareto-Levy, or GPD. As an illustration, we show the fit for the S&P500 ETF (SPY) and HerbaLife (HLF) below.