There are many different aspects of creating an effective retirement strategy for clients. While this process may take time and effort, it can help improve your clients’ overall retirement income strategy, from lowering the total amount of taxes owed to determining when to start taking Social Security benefits.

Helping clients calculate their provisional incomes can help them understand how their Social Security benefits will be taxed.

What Is Provisional Income?

Provisional income consists of half of the Social Security benefits an individual or couple receives, plus all other taxable income, including dividends, realized interest and realized capital gains. It also includes all non-taxable interest earnings, like those from municipal bonds.

Some retirees aren’t required to pay federal income taxes on Social Security benefits. Still, anyone receiving substantial income on top of their Social Security payments can be taxed on up to 85% of their benefits.

- Single taxpayers: Fifty percent of their Social Security benefits may become taxable when provisional income exceeds $25,000. Up to 85% of their Social Security benefits may be taxable if provisional income exceeds $34,000.

- Joint taxpayers: For married couples with a combined income between $32,000-$44,000, income tax could apply to up to 50% of their benefits. A combined income that exceeds $44,000 can create taxable Social Security benefits of up to 85% of the benefit amount.

Social Security benefits carry a considerable tax advantage over other types of income. Because Social Security benefits can be very tax-efficient compared to other income, retirees who hold off on receiving benefits can build larger Social Security payouts, lowering the total amount of taxes owed.

How to Calculate Provisional Income

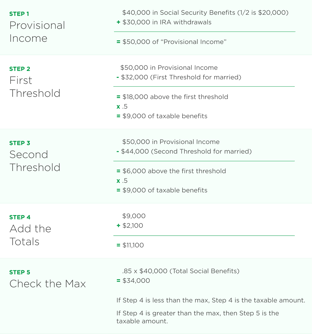

Follow these steps to calculate provisional income:

- Step 1 (Provisional income): Determine the provisional income by adding half of the total Social Security benefits plus all taxable income and non-taxable interest earnings.

- Step 2 (First threshold): Subtract the first threshold and multiply by .5 (this can vary based on whether a person is single or married).

- Step 3 (Second threshold): Subtract the second threshold and multiply by .35.

- Step 4: Add up the results.

- Step 5 (Check the maximum): If the total amount determined during Step 4 is lower than the maximum, that number is the taxable amount. If the total amount is greater than the maximum, then the amount determined in step five is the taxable amount.

Why Do Clients Need to Understand Provisional Income?

The provisional income formula is particularly interesting because only 50% of the client’s Social Security benefit is included in the calculation. This partial inclusion can create highly tax efficient retirement income streams when an advisor actively coordinates the amount of IRA withdrawals and other incomes.

That’s why it’s critical to talk about retirement income planning and to explain to clients how proactively determining income taxes is a significant part of creating an effective retirement income strategy. Clients should understand how their decisions will determine what taxes they must pay now and in the future.

Financial advisors must clearly explain to clients what they should expect regarding Social Security benefits, especially when it comes to taxes associated with decisions surrounding retirement income. Precise scenario planning using software like Tax Clarity® and Income Insight® can help financial advisors create retirement income strategies that support their clients’ needs.

What Your Clients Need to Know About Social Security Benefits

Many retired Americans rely on Social Security as their primary source of income, but could this one day become a thing of the past? With fewer taxpayers working and more retirees claiming benefits early, could the Social Security system run out of funds even faster than initially projected?

A recent Social Security report released by the U.S. government found that trust funds could be depleted by 2034, a year earlier than predicted in 2020, partly due to the COVID-19 pandemic. Download the e-book “Is Time Running out on Social Security?” to learn more.