Investors know that time in the market is their friend. Stay in the market for a long period of time, and good things will happen, even in times of high volatility.

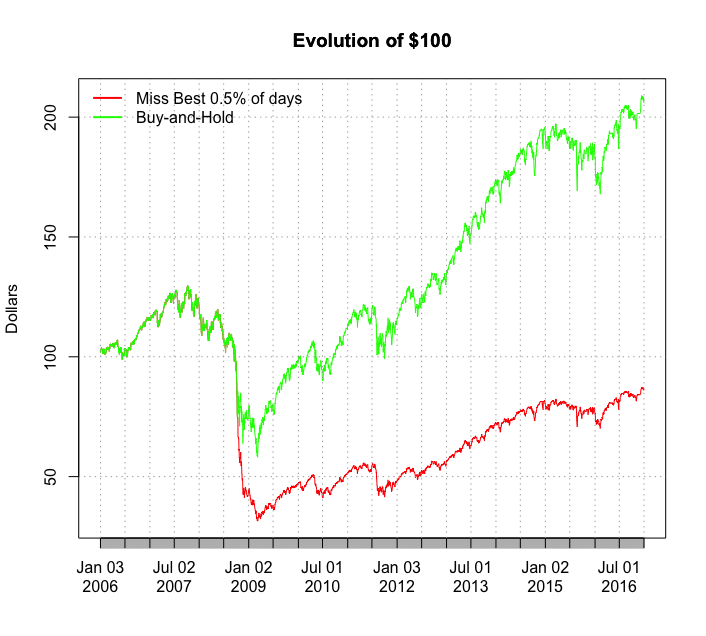

A supporting statistic is often presented: if you miss the best days, your overall return will be dramatically lower. For instance, between 01/03/2006 to 12/30/2016, a buy-and-hold strategy in the S&P500 would have turned a $100 investment into $206. If you missed the best 0.5% of days (in this case, the best 14 days), the $100 investment would have lost money, and become $86. See chart below:

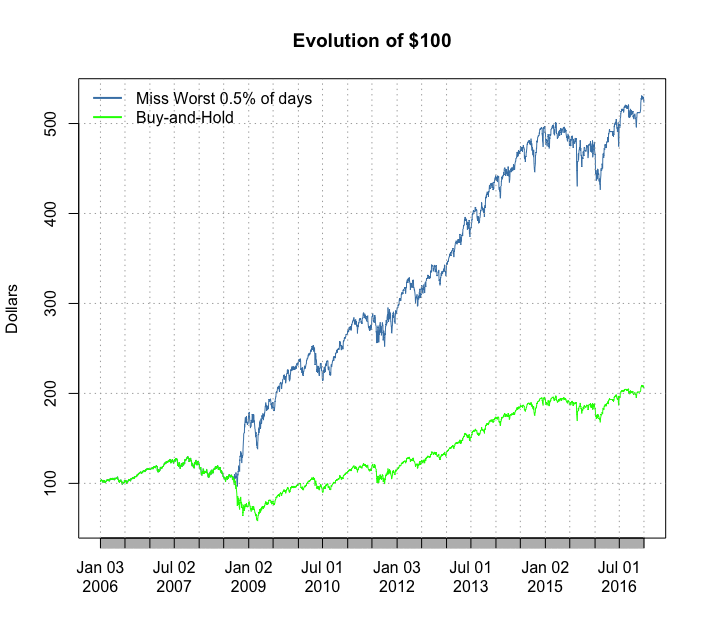

But what would happen if we were to miss the worst 0.5% of days? The $100 investment would turn into a whopping $523. The chart below illustrates this point:

The S&P500 is hardly an anomaly. We see the same pattern with different investments.

For example:

|

$100 investment in: |

Buy-and-hold |

Miss Best Days |

Miss Worse Days |

|

SPY |

$206 |

$86 |

$523 |

|

AGG |

$148 |

$116 |

$191 |

|

GIS |

$279 |

$144 |

$557 |

|

AAPL |

$1,298 |

$370 |

$4,799 |

Conclusions:

- The impact of the worst and best 0.5% of trading days (a.k.a. “the tails”) have a very significant impact on success or failure of an investment

- Avoiding the worst days is in many cases dramatically more impactful than catching the best days

- If the cost of hedging the worst 0.5% days of the S&P500 costed an average of 500bps per year, would it be worth it?

Help your clients see this in their portfolios. Sign up for a 10-day free trial of SmartRisk now.