At Covisum, we're in more than just the business of creating software. We are dedicated to creating the best retirement income planning platform for financial advisors and institutions. But we're also helping transform your advisory practice into a powerhouse of value and referrals. Our founder and president, a practicing financial advisor and Certified Financial Planner™, utilizes a game-changing approach in his own retirement income planning firm. Let's delve into the heart of it and see how our process can elevate your practice, too.

At the core of this strategy are the "Three Wows." These pillars can elevate your practice and set you on a path to success. Let's look at each wow and how they can revolutionize your practice.

The Power of the Three Wows

Wow #1 for Financial Planners: During your free trial period, you can quickly see the impact of Covisum's software.

Use Covisum software to conduct a Social Security analysis, identify the best time and amount for Roth conversions, and see the value you can deliver to your clients – in dollars.

Easy enough. Start by taking a free trial of Covisum's retirement income planning stack. Let the software automatically identify an optimal Social Security strategy and see the dollar impact. Some clients will see tens of thousands of dollars added to their bottom line. Many times, you can add hundreds of thousands in value.

Next, choose an alternate harvesting pattern. Without professional financial advice, most people withdraw from the wrong accounts at the wrong times in retirement. Structuring account withdrawals in a tax-smart way and doing strategic Roth conversions can more than double the value you delivered with the Social Security strategy. Then, add even more impact by reallocating their accounts to investments aligned with how they will use them in retirement and show them an even more significant outcome.

If this process is new to you, our customer experience team will walk you through each step. But to say it in the simplest terms:

- Use Social Security Timing to optimize your client's Social Security benefits.

- Use Income InSight to conduct Roth conversions and show your client the impact.

- Add value for clients by reallocating their accounts.

Once you've built your first plan this way, you'll say, "Wow, that is a lot of value to deliver to a client!"

Start Your 10-Day Free Trial Now!

Wow #2 for Financial Planners: Within the first 30 days, present a value-added plan to your client.

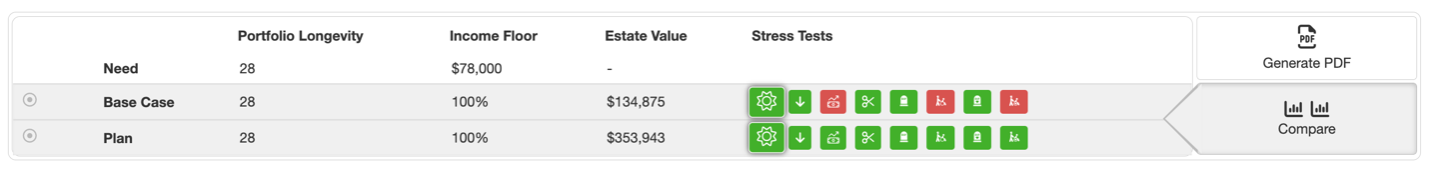

Covisum software analysis answers your client's core retirement questions better and more directly than other software by providing an Impact Estimate.

Your clients will trust you more if you can answer these common questions:

- What is this strategy worth to me?

- What if the market tanks?

- What if my Social Security benefits get cut?

- What impact will inflation have on my plan?

- What if I have a health issue and need long-term care?

- What if my spouse or I die unexpectedly?

- Will I be ok?

- How much value does your recommendation add to my bottom line?

Observe your client's response as you unveil the difference between your expert recommendations and the conventional actions they may have taken without coming to you. This is where Covisum truly shines, enabling you to effectively target retirement income clients and secure their trust by delivering unparalleled value. Covisum's Impact Estimate provides powerful insights that get right to what's critical to your clients.

Our founder uses this exercise in his own RIA to target retirement income clients and win their business by delivering more value and better answers than his competition. Presenting a retirement income strategy in this way contrasts other advisors who may rely on outdated methods such as pen and paper or software platforms ill-suited for the intricacies of retirement income planning.

Wow #3 for Financial Planners: Within one year, receive unsolicited client referrals as a testament to your value.

Referrals are the lifeblood of any successful practice. The pinnacle of referral success is when your clients voluntarily share your name with their network. Unprompted and without ulterior motives, they're vouching for your expertise and the value you've brought to their lives. Covisum aspires to empower our advisors to provide such exceptional value through our tools and processes that at least 10% of their clients voluntarily refer another client each year. For a typical solo practice bringing on 10-20 new clients a year, expecting at least one referral in your first full year of committing to the process is reasonable.

Referrals are the lifeblood of any successful practice. The pinnacle of referral success is when your clients voluntarily share your name with their network. Unprompted and without ulterior motives, they're vouching for your expertise and the value you've brought to their lives. Covisum aspires to empower our advisors to provide such exceptional value through our tools and processes that at least 10% of their clients voluntarily refer another client each year. For a typical solo practice bringing on 10-20 new clients a year, expecting at least one referral in your first full year of committing to the process is reasonable.

Advisor's Three Wows: Extending the Covisum Process to Benefit Your Clients

Covisum's software is at the heart of your client experience, akin to a routine check-up with a trusted doctor. Just as many of us go in for routine blood work, stress tests, and well visits to ensure our physical health is acceptable, it is essential to conduct regular check-ups to ensure your client's financial health will meet or exceed their expectations.

You can extend the three wows we promise to our advisors to your clients. Here's how:

Wow #1 for Your Clients: Delivering an Impact Estimate

In the initial client meeting, introduce the concept of delivering an Impact Estimate using Income InSight. Walk clients through a scenario similar to theirs, allowing them to witness firsthand how your advice can make a meaningful impact. This service should come at no additional cost. You aren't personalizing the plan at this point; you are just showing them a typical scenario for clients like them.

This exercise shows clients that you can adeptly address their questions and concerns.

Wow #2 for Your Clients: Personalized Retirement Income Plan

The second "Wow" emerges when you deliver a personalized retirement income plan. This one comes with your fee, and the value it delivers is genuinely remarkable.

Wow #3 for Your Clients: Ongoing Support and Stress Reduction

The third "Wow" comes into play approximately a year after establishing a regular meeting cadence with clients. This phase involves carefully managing their assets. Clients will express how this process relieves stress and adds substantial value, confirming the worth of their investment in you.

Ensuring consistency in the client experience is paramount. Advisors should provide clients with the peace of mind that they will adeptly handle ongoing inquiries, asset management, and stress mitigation. The ultimate objective is for your clients to declare, "Wow, that's easy."

By integrating and adapting the "Three Wows" concept into your practice for the benefit of your clients, you have the potential to craft an unparalleled client experience. Satisfied clients will be more inclined to refer you to their network, further elevating your practice's reputation and success.

Transforming Referrals, Transforming Value: A Resounding Success Story

I mentioned our founder, a Certified Financial Planner™, runs a small Registered Investment Advisor (RIA) practice using the Covisum process. His firm earned six unsolicited referrals in the past month, and four of those referrals have already signed up with the firm, bringing all of their assets with them. You can imagine the boost to the financial health of the practice. Equally significant, these referrals serve as a testament to the process's efficacy.

The essence of the Covisum approach lies in transforming how you earn referrals. Gone are the days of scripted and awkward requests. We detest the notion of manipulating connections for gain. Instead, we believe in helping you build an exceptional practice that does a better job for clients so they can't help sharing their positive experiences.

Unsolicited Referrals Multiply Lifetime Value

Why are unsolicited referrals the gold standard? These are referrals driven by authenticity and genuine satisfaction. When a client recommends your services without prompt, it shows your remarkable impact.

Let's talk numbers. Consider a client who sticks around for two decades. The implications are astounding if just 10% of your clients provide one unsolicited referral each year. Over their lifetime with your firm, the average client can potentially refer two more clients. This dynamic boosts the lifetime value of a client, not by small increments, but by two to three times its original estimation.

Calculating the Lifetime Value of a Client:

Understanding a client's lifetime value (LTV) is fundamental to making informed decisions, devising effective strategies, and fostering lasting growth. The client's LTV should serve as your compass, directing decisions related to client servicing expenses (boosting retention and fostering an exceptional experience), marketing expenses for client acquisition, resource allocation, and even your team's job satisfaction. As your practice strengthens, it empowers you to selectively work with clients who are an excellent fit for your firm, forging mutually beneficial relationships.

At its core, the LTV represents the value a client brings to your practice over their entire engagement. It includes the revenue you generate, the costs you incur, and the impact of time. Here's a breakdown of the steps involved in calculating the LTV of one client:

Step 1: Define the Time Horizon

Start by determining the time period you want to analyze. Whether you choose the average number of years a client stays with your practice or a specific duration aligned with your business strategy, this forms the foundation of your calculation.

Step 2: Identify Annual Revenue

Next, quantify the average annual revenue generated from a single client. This encompasses all the fees, commissions, and charges you accrue from them, including management fees, advisory fees, and other services rendered.

Step 3: Factor in Client Expenses

Deduct any expenses directly linked to servicing the client. This could span administrative costs (like the cost of your Covisum software subscription and your staff), trading expenses, marketing investment, and other expenditures from managing their financial affairs.

Step 4: Compute the Gross Margin

Calculate the gross margin to know the surplus you retain after offsetting client expenses against the annual revenue.

Step 5: Assess the Client Retention Rate

Evaluate the percentage of clients who stay with your practice over the chosen period you outlined in Step 1. This retention rate provides a glimpse into the loyalty and satisfaction your services evoke among your clientele.

Step 6: Unveiling the LTV Insight

The moment of truth arrives as you calculate the lifetime value of a client using the formula:

LTV = Gross Margin * (1 / (1 + Discount Rate - Client Retention Rate))

The discount rate used in calculating a client's lifetime value (LTV) is an important factor that accounts for the time value of money. Choosing the appropriate discount rate can be subjective and vary depending on your business context. The U.S. Treasury's 10-year bond yield is often used as a starting point for the discount rate.

Empowering Your Practice with LTV

Imagine this: your practice generates an annual revenue of $10,000 per client, with $4,500 in yearly client expenses. Your client retention rate is 98%, and you apply a discount rate of 8%.

Gross Margin = $10,000 - $4,500 = $5,500

LTV = $5,500 * (1 / (1 + 0.08 - 0.98)) = $$55,000

LTV = $55,000

Do the same exercise with a smaller group of your best clients. LTV is likely considerably higher.

Unveiling Insights, Shaping Strategy

In our example, the calculated LTV of one client amounts to approximately $55,000, but for some practices, it's easily over $100,000. The number is often even higher for subsets of "ideal clients" for a practice. When viewed through this lens, you can make more educated decisions about investing in the client experience – not just staffing to answer their calls in a more timely manner, but processes to answer their questions proactively. This philosophy lies at the heart of Covisum's software. We are dedicated to crafting tools that excel at providing better answers to your most valued subscribers' questions.

The LTV isn't just a number; it's a revelation that transforms how you perceive the value you deliver to your clients and your practice's potential. Harness its power, and watch your practice thrive as you nurture relationships grounded in authentic value and long-term mutual prosperity.

The Covisum Difference

Are you ready to take your financial advisory practice to the next level? Covisum is your partner in achieving the Three Wows that can redefine your practice's success. Embrace a process that transcends the ordinary and drives referrals through authentic value. Experience the Covisum difference today and pave the way for a genuinely exceptional practice.

.png?width=800&height=300&name=Covisum%20LTV%20(800%20x%20300%20px).png)