By now, financial advisors are keen on the idea that Roth conversions can be a very good thing for their clients and their financial planning practice. Why?

By now, financial advisors are keen on the idea that Roth conversions can be a very good thing for their clients and their financial planning practice. Why?

- Roth conversions can help your clients lower their taxes in the future.

- Contributions and earnings grow tax-free.

- Clients can withdraw contributions (not earnings) at any time and for any reason, tax-free.

Moving your client’s money to a Roth IRA means they won’t have to take required minimum distributions (RMDs) on their account when they reach age 72. They can keep the money in the account and pass it on to the people and causes they care about.

But if converting funds to a Roth IRA was a no-brainer, who needs financial advisors? Who needs fintech?

Your clients do. And you do.

Too Many Rules Makes Things Complicated

There are rules, stipulations, and caveats to conducting Roth conversions. Let’s talk about all that tax-free stuff. Of course, there’s a caveat. With a Roth conversion, your clients must pay the tax bill on their conversion in the year it takes place. This tax bill could be substantial. Are you prepared to help your clients manage that tax bill now to reap the benefits of the conversion in the years to come? You should be. (HINT: Keep reading to see how to use Income InSight reports to show clients all their retirement income streams in one place.)

And although Roth conversions are a solid retirement income planning tactic, it’s not the only thing you should consider for your clients. What about calculating taxes when you combine other income streams? That sounds messy. Truth be told, it can be beyond complicated – for both consumers and their financial advisors (HINT: That’s where our tech comes in!).

Try the Covisum Software Platform for Free for 10 Days.

Here’s the (potentially literal) million dollar question: How would you optimize your client’s retirement income strategy if they came to you with several different types of retirement savings, including 401(k)s, 403(b)s, IRAs, fixed annuities, brokerage accounts, and certificates of deposit? To further complicate things, retirement income planning doesn’t only account for savings. Most of your clients will need your help with Social Security (hopefully, you optimized their claiming strategy with Social Security Timing®) and possibly pensions.

Enter Income InSight, a retirement income planning software explicitly built for advisors. The software makes it easy to see all your clients’ retirement dollars and determine which account they should draw from and when. And with several new features, Income InSight now has more to offer than ever. Keep reading and look for (NEW!) features to be called out. We’re listening to advisor feedback and taking your input to heart as we build our product roadmap.

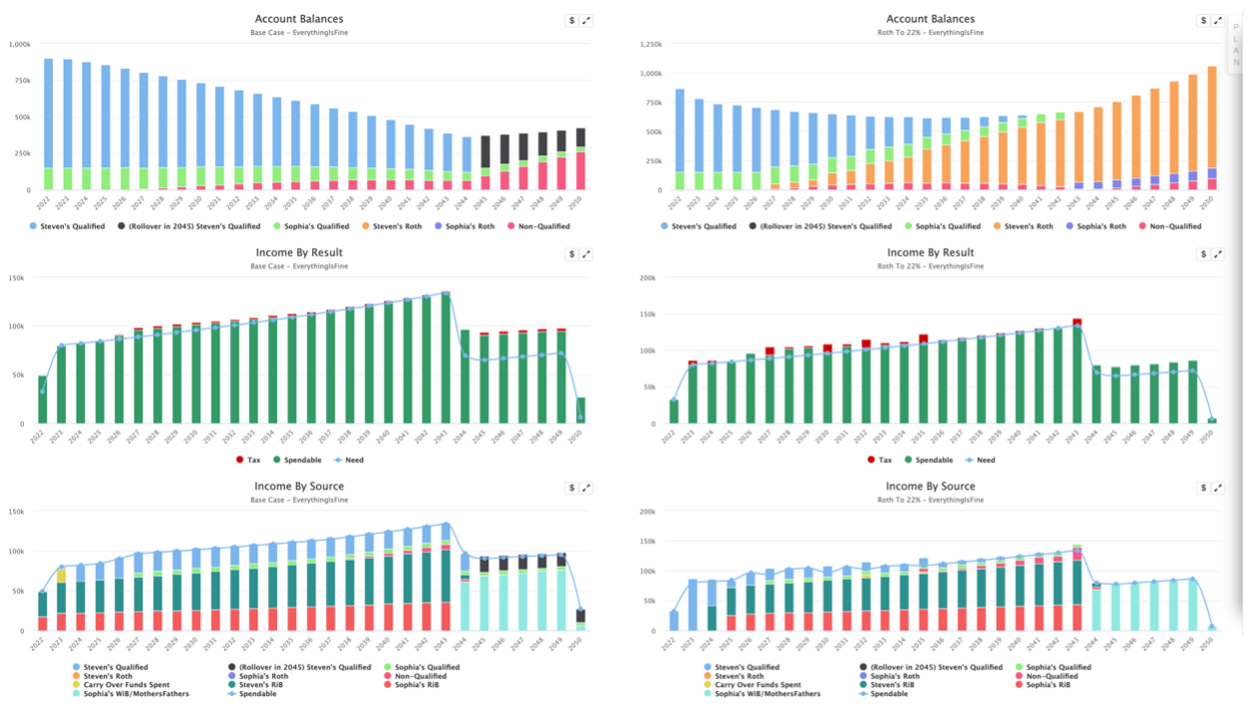

Income InSight is easy to use. To get started, log in, click on “add a client”, and follow the wizard. Once you’ve entered your client’s account information, the results page displays easy-to-understand charts with their account balances, income by source, and income by results.

- Show clients how long their money will last and how much will remain for the people and causes they care about.

- Show them how much money they can spend and how much they will pay in taxes.

- Highlight which accounts will fund their income throughout their retirement.

- Compare and demonstrate differences between your client’s base case and plan case side-by-side.

Each of these graphs can be isolated and enlarged for on-screen presentations. Additionally, you can click on the individual graphs to review the cashflows in more detail. Specifically, we recently added more detail to the income by source graph. When you click into more details to review the cashflows, you can review the tax generated by the Roth conversion (NEW!) and the conversion tax paid (NEW!).

Retirement Income Planning and Taxes

Remember when we were hinting about how complicated taxes make things? Luckily, you can use Tax Clarity® to find tax opportunities in retirement. Quantifying the single-year impact of various conversion strategies enables you to show your clients how to make an educated decision about a conversion and how to avoid potential pitfalls, like entering a new bracket, creating Social Security tax, or creating unnecessary Medicare expenses.

But it doesn’t stop there. It’s also important to consider the impact of taxes over the client’s lifetime. Income InSight generates a multi-year Tax Map, so you can see which tax brackets the client will be in throughout their entire retirement. In addition, the Tax Map helps you find opportunities to take advantage of tax strategies like Roth conversions. With the click of a button, you can add a Roth conversion to the plan and show clients the impact in dollars.

And depending on your client’s tax situation, Income InSight can do some complex Roth conversions too. For example, let’s say your clients have an effective marginal tax rate above the harvesting threshold. Income InSight will automatically convert a small amount at the higher tax rate, then switch to the lower tax rate if possible (NEW!).

If your client’s effective marginal tax rate is less than the conversion threshold, we now allow you to illustrate the conversion when there is no non-qualified account to pay tax from (NEW!).

Stress Testing Retirement Income Plans

What if something terrible happens? What if your best-laid plans don’t work out? What will your client do? Will they be ok? How will they know?

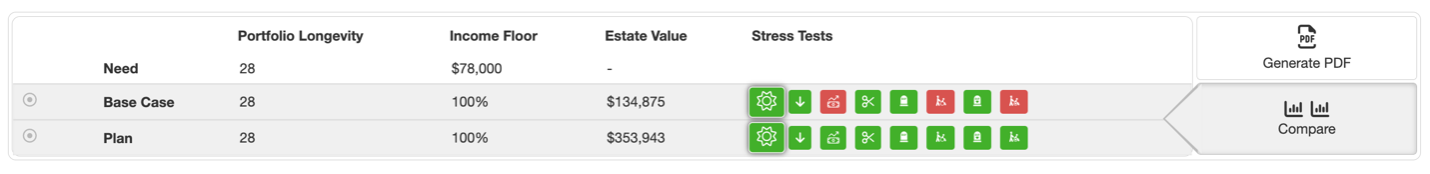

Stress testing is one of the best ways to determine if your clients’ retirement income strategy can withstand unforeseen circumstances like a down market early in retirement or a long-term care need. Use the stress test icons at the top of the Income InSight results screen to communicate if your client will be all right or if they need to consider a plan change. Green means good; red means the plan runs out of money.

You can instantly stress test your income plan against:

- A down market

- A long-term health care need

- An early death

- High inflation (NEW!)

- Cuts to Social Security benefits

Click on any stress test icon, and you’ll get a narrative about the stress test and what happened. Then, you can click on the “Show Me” button, and the results will update and display the case under the new circumstances. Now you can adjust the plan to solve for the failed stress test.

Get Started with the Covisum Platform Today

Your clients have questions about retirement, Social Security, and taxes. You need answers. Covisum’s retirement income planning software can help you grow faster by setting you apart from the competition. Clients can see the value of your advice in dollars.

Covisum simplifies calculating and preparing retirement income strategies for your clients. When you subscriber to Covisum software, you get an entire support team to help you answer subject matter questions. Try Covisum's retirement income planning software for free for 10-days. No commitment or credit card is required.