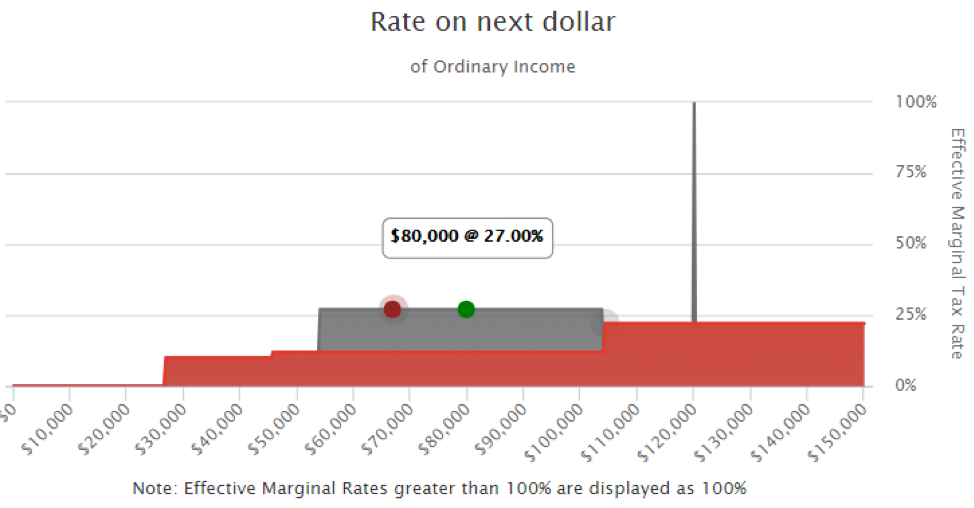

Hidden Value is a column in ThinkAdvisor where Joe Elsasser, CFP®, answers common questions with insights advisors and their clients may not have considered. This week he takes a closer look at the tax implications and the hidden tax-efficient planning opportunities created through interactions between various cash sources.

Read