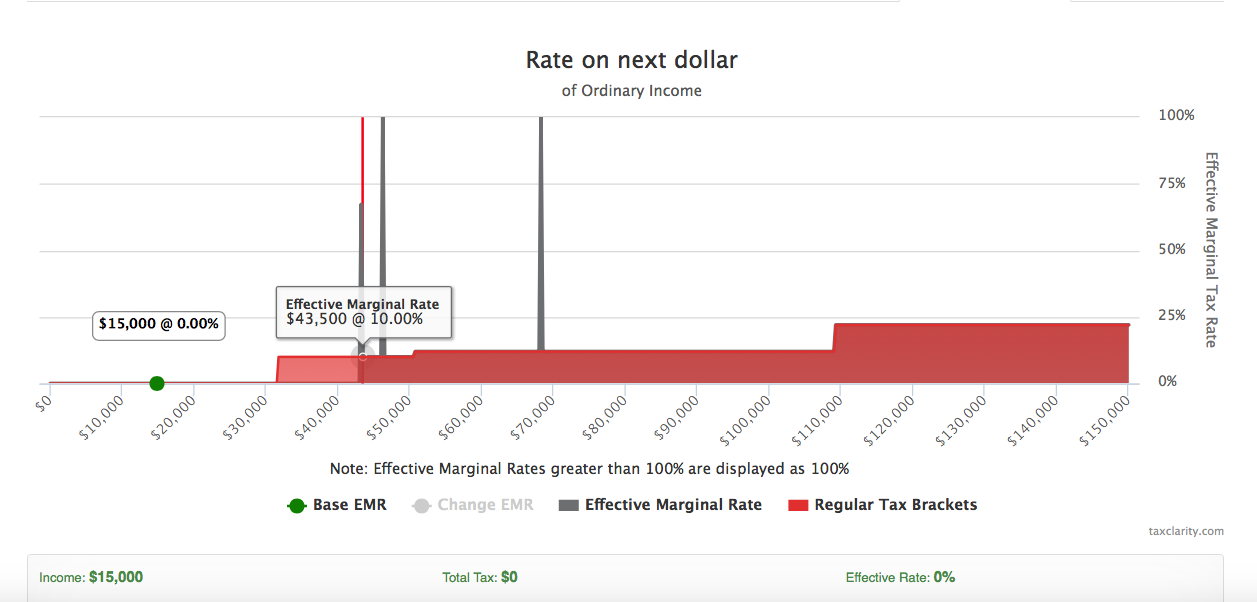

Q: What does the gray portion of the Tax Map represent? A: The gray portion of the Tax Clarity® Tax Map represents the effective marginal rate (EMR). If you are looking at the “Rate on the next dollar of ordinary income” map, the software indicates at each ordinary income dollar (i.e. IRA distribution, pensions, earned income, etc.) how that ordinary income dollar and other income (Social Security, capital gains, self-employment, etc.) will be taxed. In other words, the software assesses what is being taxed at that ordinary income dollar amount and adds all of the taxation together. That is why the EMR may be higher than the ordinary income or capital gains tax bracket at certain times. The gray portion of the Tax Map allows you to determine just how many ordinary income or capital gains dollars, such as qualified dividends, your client will have before triggering another taxation point.

Read