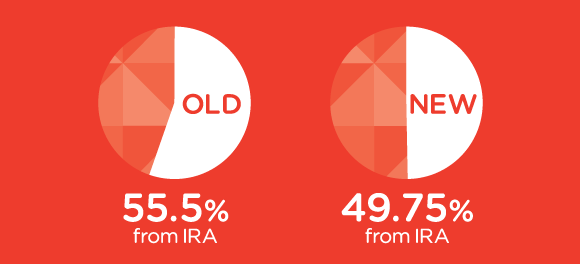

Now is the time to build relationships with CPAs At this point, it seems safe to expect some form of tax reform will pass in the next several months. The House has already passed H.R. 1, the “Tax Cuts and Jobs Act,” which includes a variety of changes to the personal income tax system and significant changes to corporate taxation. The Senate has released its proposal, which doesn’t reduce the number of brackets, but does smooth the progression with level steps between each new proposed bracket. Both bills increase standard deductions, eliminate some itemized deductions, eliminate personal exemptions, and provide some sort of child/dependent tax credit. Regardless of the compromises that emerge through the political process, it is clear that there will be a need for members of the general public to understand the changes and how those changes impact their personal situations. Financial advisors will be faced with a choice – either take proactive steps to first become educated on the new laws, and then identify specific opportunities for their clients, or risk losing clients to other proactive advisors who choose the first path.

Read