A Complete and Comprehensive Retirement Investment Strategy

Successful advisors are using Income InSight® to answer specific client questions and seamlessly transition to a broader financial planning discussion. The retirement planning platform can help you identify and project how expenses, income streams, accounts, investments, and insurance can be used throughout the client’s lifetime to show them the after-tax retirement lifestyle they desire. Read on to see how you can differentiate yourself in the marketplace and add measurable value to the retirement investment strategies you produce.

Case Study

Bill Bailey is an independent financial planner with a small firm. He has $50 million in assets under management and primarily serves mass-affluent retirees and pre-retirees. Last week, he conducted a tax-efficient retirement seminar in his local library, and 30 people attended.

Cam and Carmen Cole, who attended Bill’s seminar, are interested in his services. They are a married couple who are planning to retire soon and want to ensure that they can meet their retirement goals. The Cole’s are aware that certain environmental and life circumstances can impact their retirement outcomes and want to make sure that they are able to survive through any given scenario.

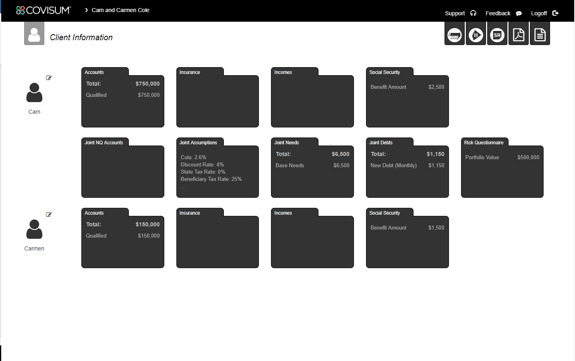

Bill contacts Cam and Carmen a few days prior to their scheduled appointment to gather more information about their goals, their questions, and their assets. He adds their information to on the client information page in Income InSight. Bill uses the software to provide a visual of how long their money will last in retirement and to run various stress tests for common risk factors.

Cam has $750,000 in a qualified account and Carmen has $150,000 in a separate qualified account. Cam has $2,500 in a Social Security benefit amount and Carmen has $1,500. Income InSight also includes joint folders and options to enter insurance and other income.

When the Cole’s arrive at the office for their appointment, Bill runs a report in Income InSight and explains what he’s found.

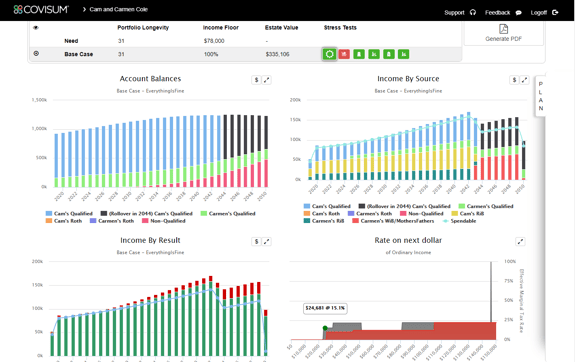

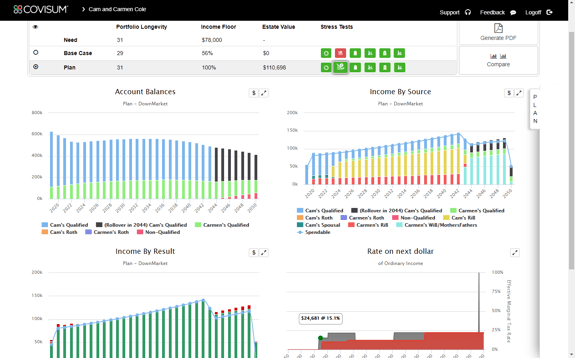

He starts by showing them the overview page, where they can see their account balances, income by source, income by result and their customized Tax Map. The Cole’s money is going to last them through 30 years of retirement if no stress events impact their plan.

Weathering A Down Market

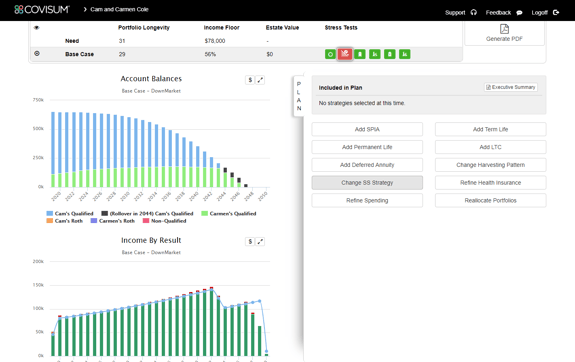

However, there is one scenario that could wreak havoc to their retirement investment strategy, a down market. Bill knows that it’s better to set proper downside expectations with his clients so that they don’t make a hasty decision with their money when it could be detrimental to their future. The down-market stress test in Income InSight helps Bill demonstrate his value and show the Cole’s how he would recommend they allocate their investment funds.

Together, Bill and the Cole's take a closer look at the graphs and see that their money would not last in the event of a down market, as represented by the red button.

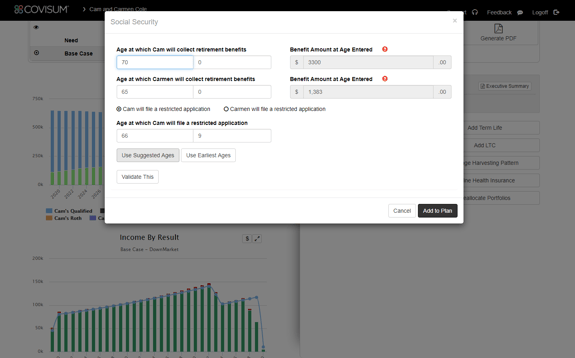

Income InSight recognizes this issue, and Bill creates a plan to ensure that Cam and Carmen can prepare for this event. He uses the software to manipulate their Social Security strategy and recommends they delay claiming, which will help them close the gap.

Bill runs an updated report for Cam and Carmen. With this new plan, they are prepared in the event of a down market.

With the help of Income InSight, Bill is able to clearly show his clients the value of his advice. Cam and Carmen can imagine a successful retirement and feel confident that their money will last throughout their retirement, even if they encounter a down market. Even better, Bill was able to add more to the Cole’s bottom line.

After the conclusion of the first meeting, Bill mentions that he can also help Cam and Carmen create a tax-efficient retirement investment strategy. He sets a future meeting to help them identify potential opportunities to make their retirement strategy more tax-efficient by using Tax Clarity®.

Your Tech Stack

Whether you use Social Security Timing® to optimize a social security strategy, Tax Clarity to identify tax opportunities, or SmartRisk™ to analyze portfolio risk, these software options can aid in growing and expanding your business. Combine these tools with Income InSight to create one space to illustrate multiple financial planning technique, and show clients what their retirement could look like.

Or take a trial of any of the Covisum software for financial advisors.